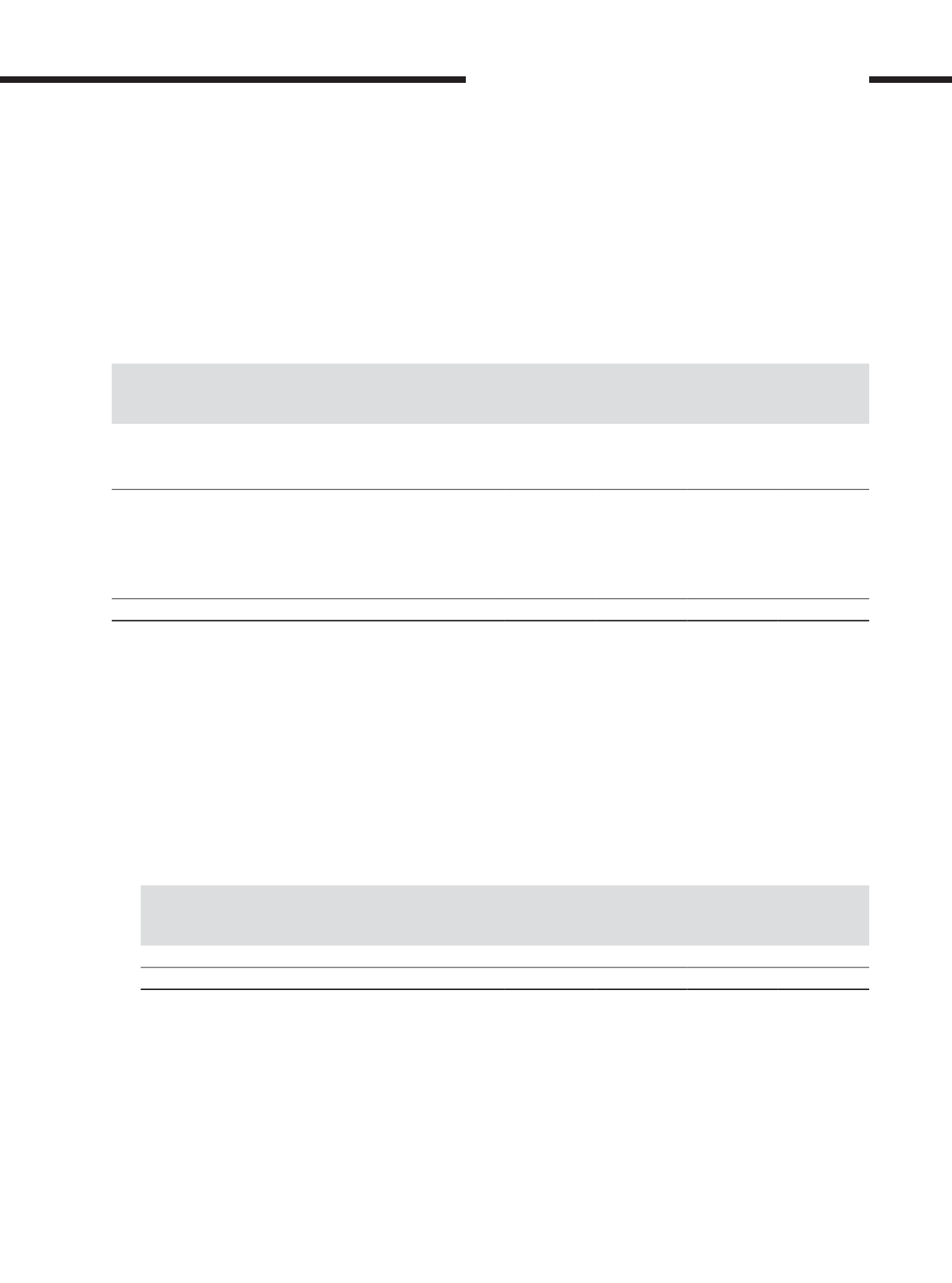

20. Amount due from/(to) associates

Group

Company

2017

RM’000

2016

RM’000

2017

RM’000

2016

RM’000

Amounts due from associates

– current

147,617

511,446

107,817

282,047

– non-current

–

344,861

–

344,861

147,617

856,307

107,817

626,908

Amounts due to associates

– current

(59,499)

(3,978)

(46,645)

(25,290)

– non-current

(86,292)

(118,898)

(8,082)

(21,934)

(145,791)

(122,876)

(54,727)

(47,224)

The amounts due from associates are trade, unsecured, interest free and have no fixed terms of repayment other than non-current

amounts due from associates in prior year which are not expected to be repaid within 1 year. Amounts due from associates in the

prior year includes advances to PT Indonesia AirAsia (“IAA”) for purchase of aircraft in 2011 for the financing of aircraft purchase.

These amounts have been eliminated in the current financial year following the consolidation of IAA effective 1 January 2017.

(i) Financial assets that are neither past due nor impaired

Amounts due from associates that are neither past due nor impaired of the Group and Company amounted to RM147,617,000

and RM107,817,000 (2016: RM519,795,000 and RM519,795,000) respectively.

(ii) Financial assets that are past due but not impaired

Amounts due from associates of the Group and Company that are past due but not impaired amounted to RM nil (2016:

RM336,512,000 and RM107,113,000). The ageing analysis of these amounts is as follows:

Group

Company

2017

RM’000

2016

RM’000

2017

RM’000

2016

RM’000

Up to 1 year

–

336,512

–

107,113

–

336,512

–

107,113

The Group and Company have not made any impairment as management is of the view that these amounts are recoverable.

(iii) Financial assets that are impaired

There are no amounts due from associates of the Group and Company that are past due and impaired.

The maximum exposure to credit risk at the reporting date is the carrying value of the amounts due from associates mentioned

above.

[ ]

315

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS