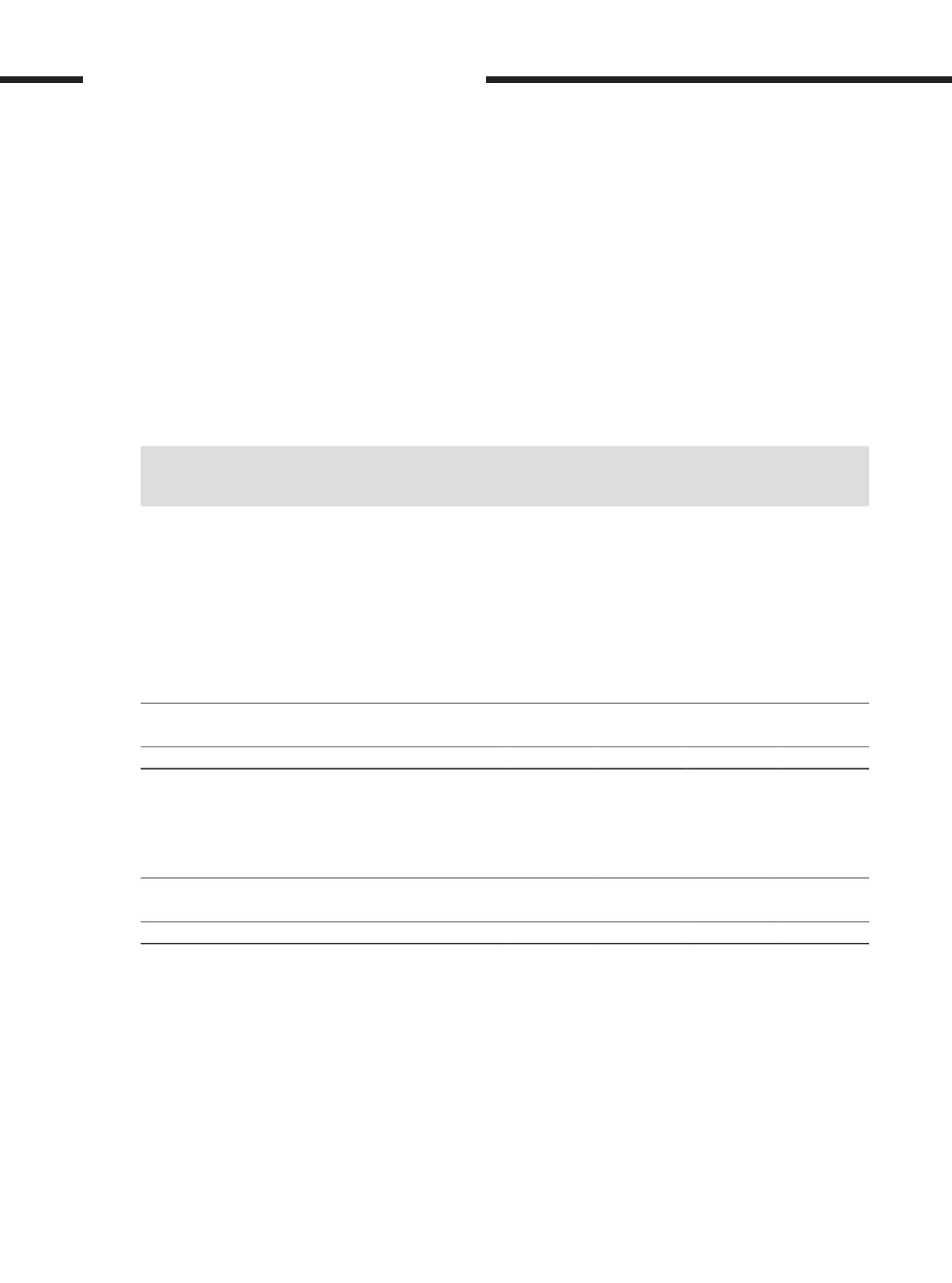

17. Deferred tax assets/(liabilities) (cont’d.)

The movements in the deferred tax assets and liabilities of the Group and the Company during the financial year are as follows:

(cont’d.)

(a) Deferred tax assets (cont’d.)

Group

Company

2017

RM’000

2016

RM’000

2017

RM’000

2016

RM’000

Deferred tax assets (before offsetting)

Unabsorbed capital allowances

723,419

955,972

723,419

955,972

Unabsorbed investment tax allowances

1,334,948

1,274,056

1,332,181

1,274,056

Unutilised tax losses

9,580

8,803

8,803

8,803

Sales in advance

154,589

145,445

154,171

145,445

Provisions and others

31,986

27,296

31,769

27,296

Receivables

25,312

4,878

25,312

4,878

Derivatives

61,231

–

61,231

–

2,341,065 2,416,450 2,336,886 2,416,450

Offsetting

(1,854,185)

(1,667,239)

(1,851,330)

(1,667,412)

Deferred tax assets (after offsetting)

486,880

749,211

485,556

749,038

Deferred tax liabilities (before offsetting)

Property, plant and equipment

(1,739,432)

(1,610,020)

(1,739,499)

(1,610,193)

Payables

(114,753)

–

(111,831)

–

Derivatives

–

(57,219)

–

(57,219)

(1,854,185)

(1,667,239)

(1,851,330)

(1,667,412)

Offsetting

1,854,185

1,667,239

1,851,330

1,667,412

Deferred tax liabilities (after offsetting)

–

–

–

–

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

[ ]

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS

310