16. Intangible assets (cont’d.)

Impairment testing for goodwill and landing rights (cont’d.)

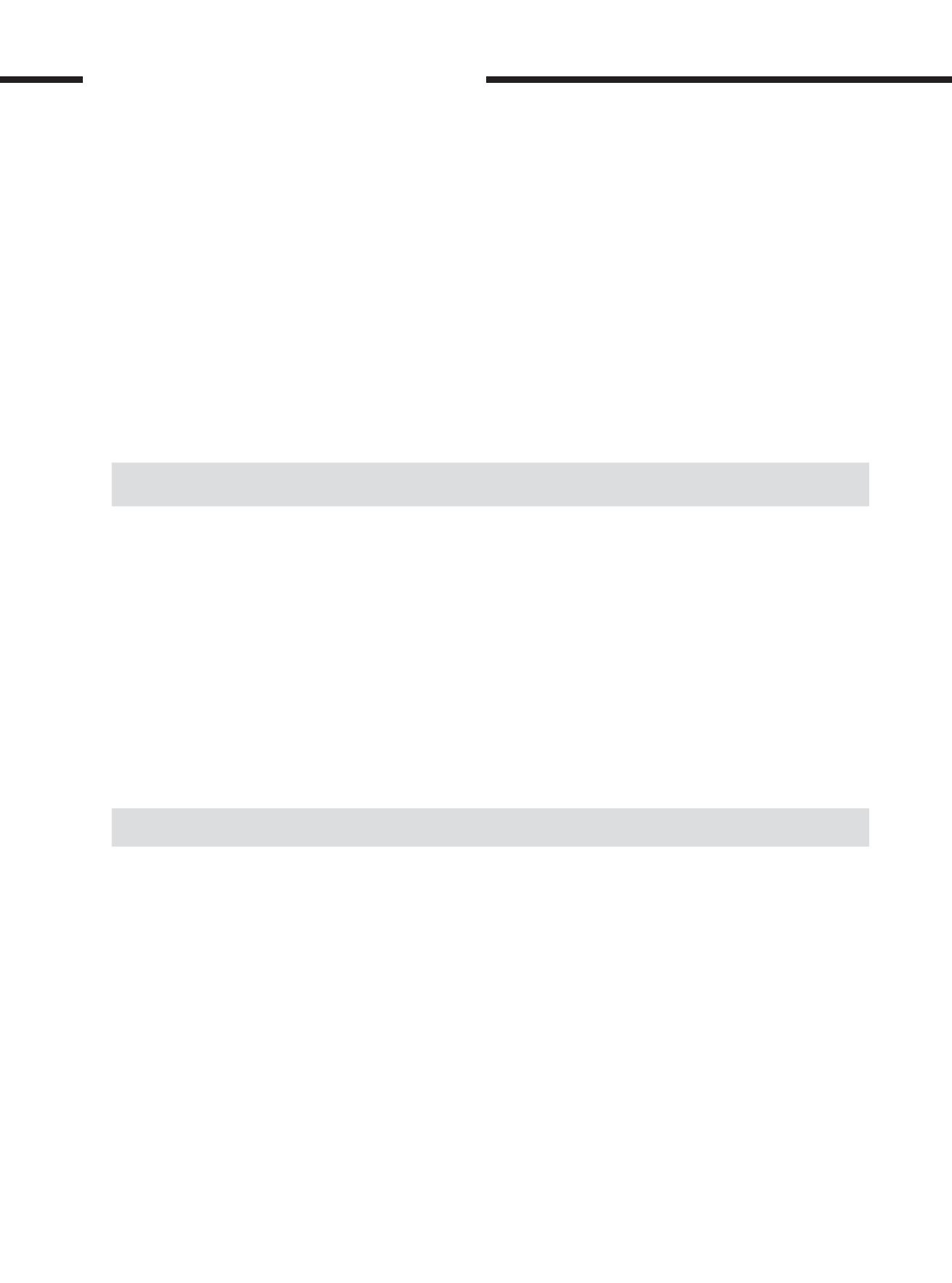

The recoverable amounts of the CGUs were computed using fair value less cost to sell method based on calculations using cash

flow projections from financial budgets approved by the management covering a five-year period. The discount rates applied to the

cash flow projections and the forecasted growth rates used to extrapolate the cash flows beyond the five-year period are as follows:

Growth rates

Discount rates

2017

2016

2017

2016

CGU

MAA

3%

3%

11.5%

11.6%

IAA

4%

–

16.5%

–

PAA

2%

–

14.5%

–

The calculation of fair value for the IAA CGU is most sensitive to the following assumptions:

Growth rates:

the forecasted growth rates are based on published industry research and do not exceed the long term

average growth rate for the industries relevant to the CGUs.

Discount rates:

discount rates reflect management’s estimate of the risks specific to these entities. In determining

appropriate discount rates for each unit, consideration has been given to the applicable weighted average

cost of capital for each unit.

The recoverable amount of the investment in IAA is within level 3 of the fair value hierarchy. The following table summarises the

quantitative information about the significant unobservable inputs used in level 3 fair value measurement:

Description

Unobservable inputs*

Inputs

Relationship of unobservable

inputs to fair value

IAA

Discount rate

16.5%

Increased discount rate of 1%

would decrease fair value by

RM88,000,000

Long-term growth rate

per annum

4%

Decreased long-term growth rate

by 1% would decrease fair value

by RM57,200,000

* There were no significant inter-relationships between unobservable inputs that materially affect the fair value.

Based on the assessments performed, there is no impairment of goodwill and landing rights attributable to the CGUs. As for MAA

and PAA, management believes no reasonably possible change in any of the above key assumptions would cause the carrying

value, including goodwill, of the unit to materially exceed its recoverable amount.

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

[ ]

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS

308