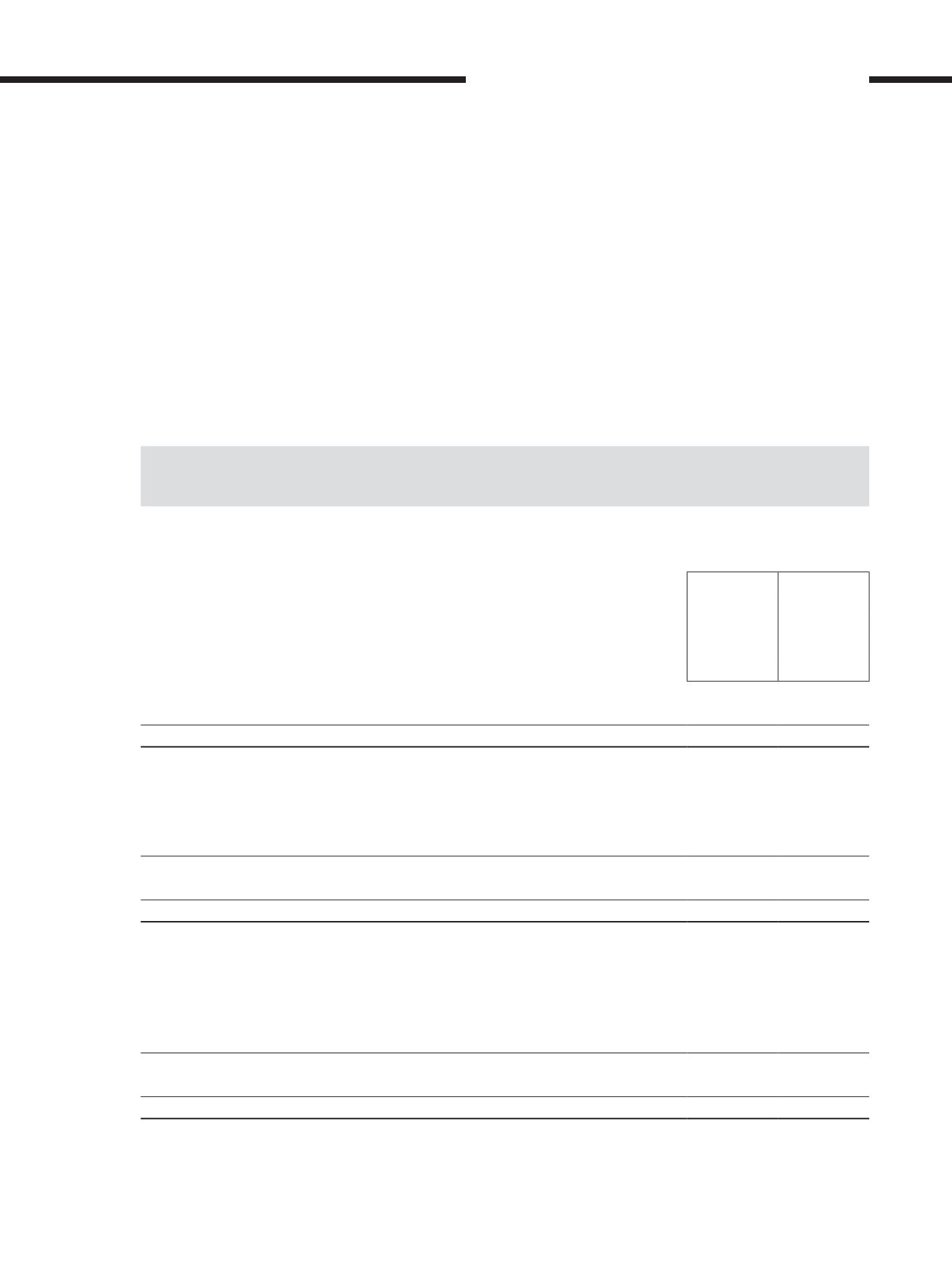

17. Deferred tax assets/(liabilities) (cont’d.)

The movements in the deferred tax assets and liabilities of the Group and the Company during the financial year are as follows:

(cont’d.)

(b) Deferred tax liabilities

Group

2017

RM’000

2016

RM’000

Deemed acquisition of subsidiaries (Note 12)

120,955

–

Credited/(charged) to income statements

– Property, plant and equipment

1,736

–

– Unutilised tax losses

(193,037)

–

– Finance lease

(12,040)

–

– Provision for retirement benefits

2,230

–

– Others

(260)

–

(201,371)

–

Exchange differences

(24,538)

–

At end of financial year

(104,954)

–

Deferred tax assets (before offsetting)

Property, plant and equipment

1,736

–

Provision for retirement benefits

15,599

–

Unutilised tax losses

22,466

–

Others

1,673

–

41,474

–

Offsetting

(41,474)

–

Deferred tax assets (after offsetting)

–

–

Deferred tax liabilities (before offsetting)

Fair value on intangible assets

(114,440)

–

Finance leases

(6,265)

–

Others

(1,185)

–

Exchange differences

(24,538)

–

(146,428)

–

Offsetting

41,474

–

Deferred tax liabilities (after offsetting)

(104,954)

–

[ ]

311

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS