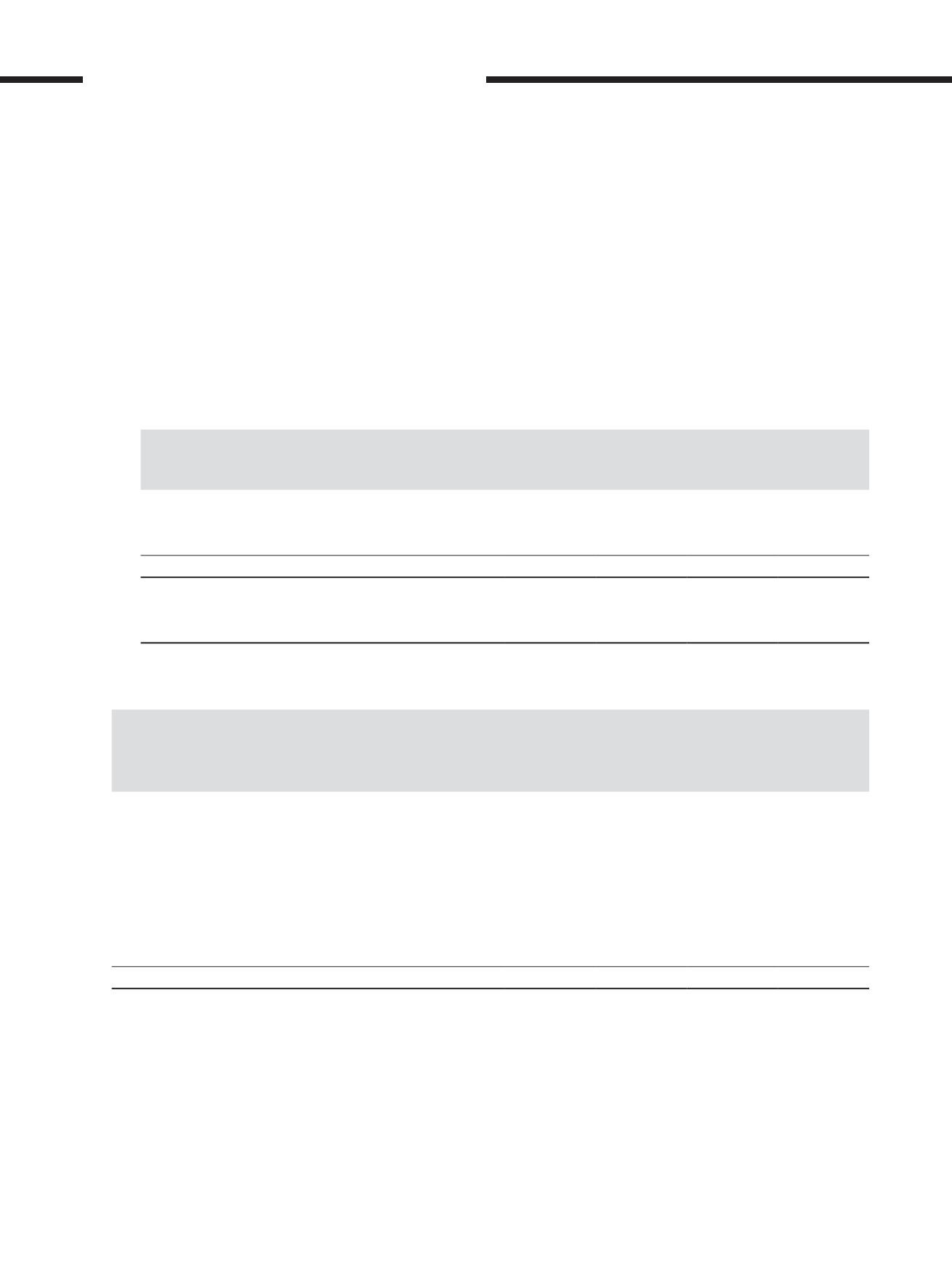

20. Amount due from/(to) associates (cont’d.)

(iii) Financial assets that are impaired (cont’d.)

The currency profile of the amounts due from/(to) associates is as follows:

Group

Company

2017

RM’000

2016

RM’000

2017

RM’000

2016

RM’000

Amounts due from associates

– US Dollar

147,617

856,307

107,817

626,908

– Ringgit Malaysia

–

–

–

–

147,617

856,307

107,817

626,908

Amounts due to associates

– US Dollar

(145,791)

(122,876)

(54,727)

(47,224)

21. Derivative financial instruments

Group

2017

2016

Assets

RM’000

Liabilities

RM’000

Assets

RM’000

Liabilities

RM’000

Non-current

Interest rate swaps – cash flow hedges

6,772

(50,745)

5,335

(105,678)

Interest rate swaps – held for trading

4,219

(20,138)

4,272

(42,374)

Interest rate caps – held for trading

12

–

261

–

Forward foreign exchange contracts – cash flow hedges

239,902

–

536,825

–

Forward foreign exchange contracts – held for trading

54,309

–

184,434

–

Cross currency interest rate swaps – cash flow hedges

38,802

–

71,156

–

Cross currency interest rate swaps – held for trading

38,161

–

65,666

–

Total

382,177

(70,883)

867,949

(148,052)

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

[ ]

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS

316