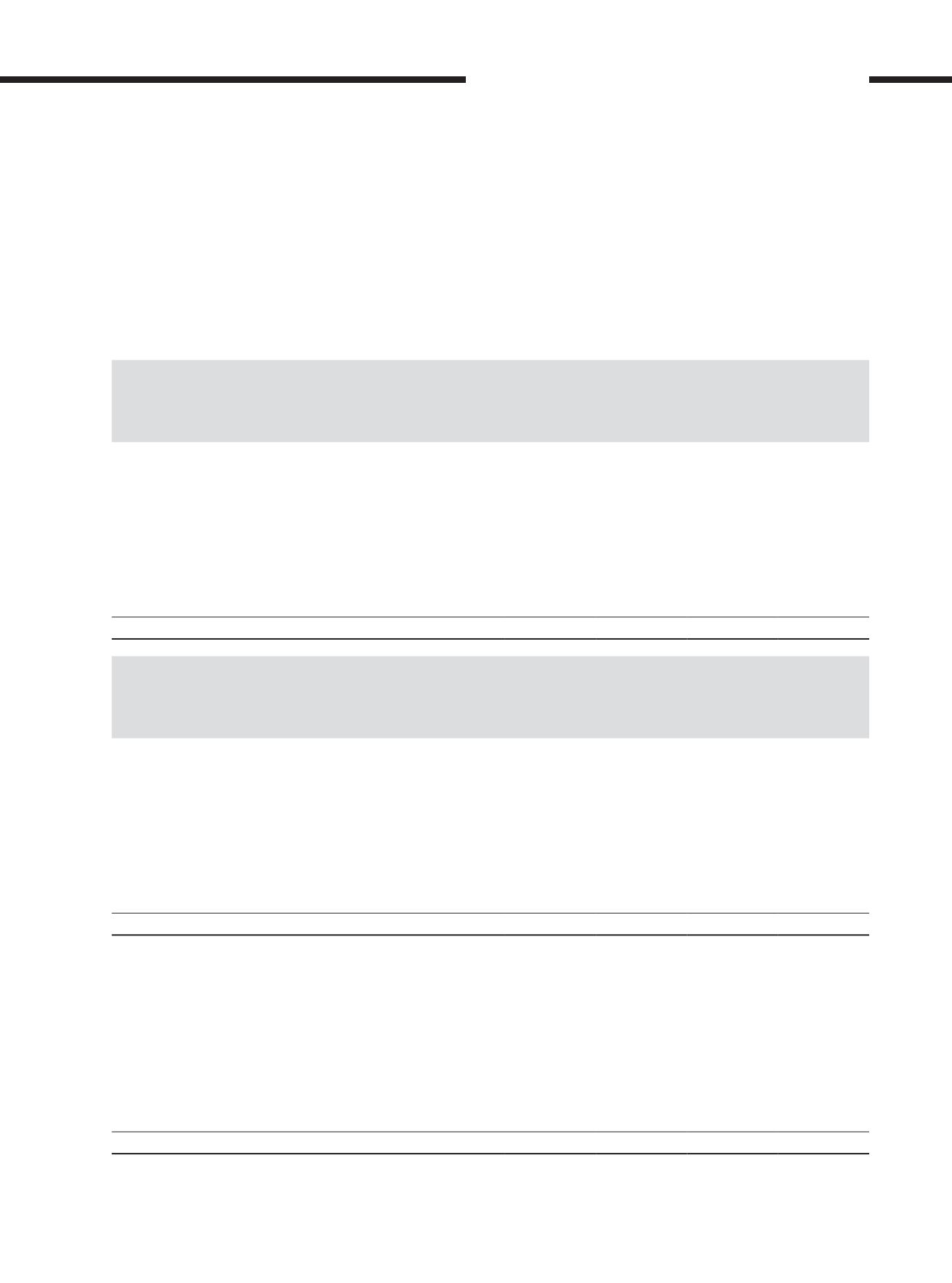

Group

2017

2016

Assets

RM’000

Liabilities

RM’000

Assets

RM’000

Liabilities

RM’000

Current

Interest rate swaps – cash flow hedges

–

(3,103)

–

–

Interest rate swaps – held for trading

106

(18,609)

–

(33,123)

Forward foreign exchange contracts – cash flow hedges

41,758

–

62,443

–

Forward foreign exchange contracts - held for trading

58,779

(1,602)

–

–

Commodity derivatives – cash flow hedges

–

–

495,572

(343,751)

Commodity derivatives – held for trading

102,452

(51,538)

104,373

(71,999)

Cross currency interest rate swaps – held for trading

2,285

–

3,280

–

Total

205,380

(74,852)

665,668

(448,873)

Company

2017

2016

Assets

RM’000

Liabilities

RM’000

Assets

RM’000

Liabilities

RM’000

Non-current

Interest rate swaps – cash flow hedges

6,772

(50,723)

5,335

(105,678)

Interest rate swaps – held for trading

4,219

(20,138)

4,272

(42,374)

Interest rate caps – held for trading

12

–

261

–

Forward foreign exchange contracts – cash flow hedges

239,902

–

536,825

–

Forward foreign exchange contracts – held for trading

54,309

–

184,434

–

Cross currency interest rate swaps – cash flow hedges

38,802

–

71,156

–

Cross currency interest rate swaps – held for trading

38,161

–

65,666

–

Total

382,177

(70,861)

867,949

(148,052)

Current

Interest rate swaps – cash flow hedges

–

(3,103)

–

–

Interest rate swaps – held for trading

106

(18,609)

–

(33,123)

Forward foreign exchange contracts – cash flow hedges

41,758

–

62,443

–

Forward foreign exchange contracts – held for trading

58,779

(1,602)

–

–

Commodity derivatives – cash flow hedges

–

–

495,572

(343,751)

Commodity derivatives – held for trading

102,452

(67,283)

104,373

(71,999)

Cross currency interest rate swaps – held for trading

2,285

–

3,280

–

Total

205,380

(90,597)

665,668

(448,873)

21. Derivative financial instruments (cont’d.)

[ ]

317

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS