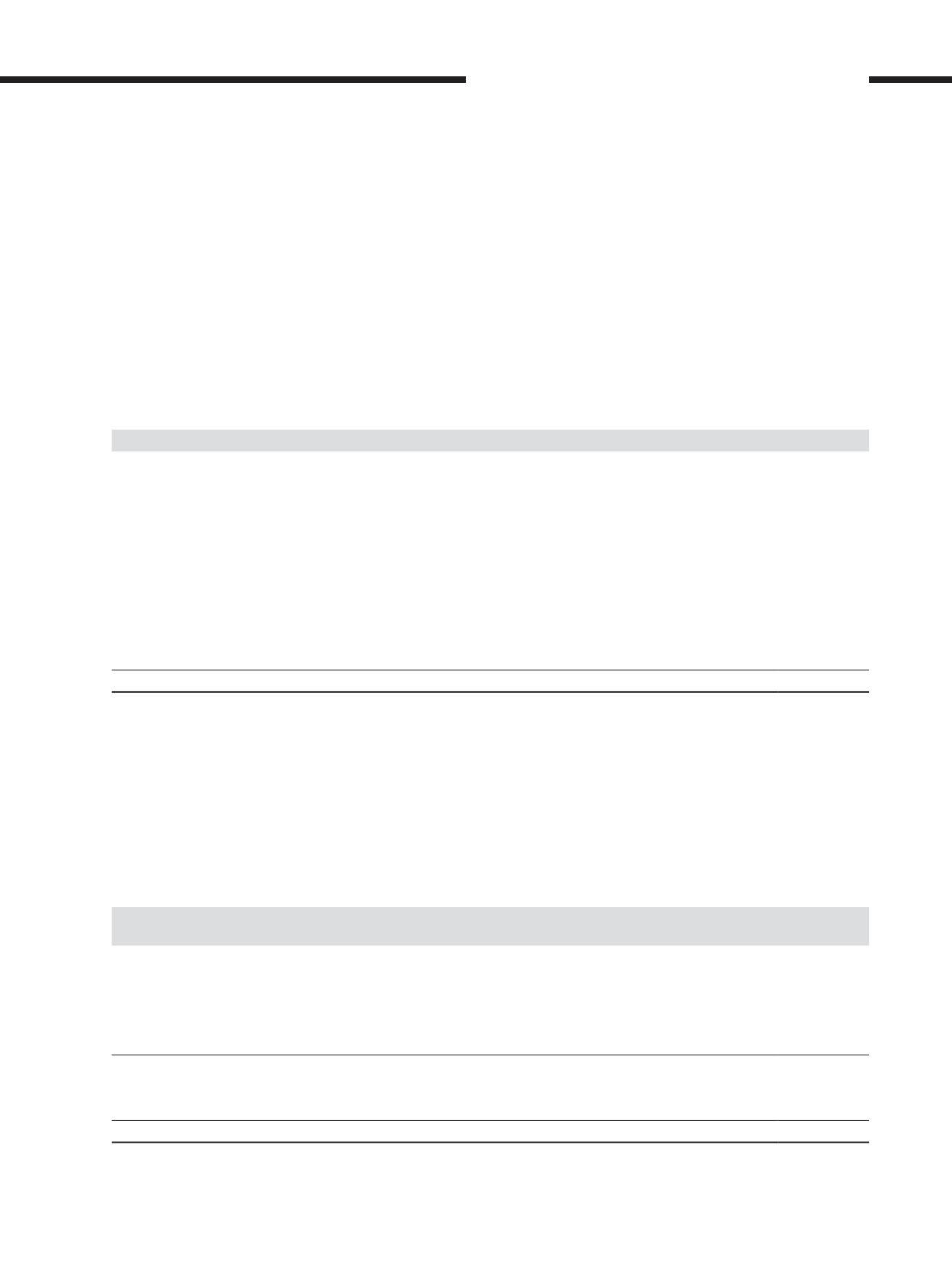

12. Investment in subsidiaries (cont’d.)

Incorporation of subsidiaries

During the year, the Group incorporated the following subsidiaries for a total paid up ordinary share capital of RM6,210,689.

RM

AAPL

6,206,961

AACIL

480

AAC1

406

AAC2

406

AAC3

406

AAC4

406

CA1

406

CA2

406

CA3

406

CA4

406

6,210,689

Acquisition of additional interest in BIG

In prior year, on 3 February 2016, the Company entered into a Share Sale Agreement with Tune Money International Sdn Bhd for the

acquisition of up to 2,072,000 ordinary shares of RM1.00 each representing 24.9% equity interest in the issued and paid up ordinary

share capital of Think BIG Digital Sdn Bhd (“BIG”) for a cash consideration of RM101.5 million. The acquisition was completed on 29

February 2016. Subsequent to this, the Company’s equity stake in BIG has increased to 69.3% and the investment in BIG has been

reclassified from investment in associate to investment in subsidiary. This acquisition allows the Company to extract greater value

from the AirAsia BIG Loyalty Programme managed by BIG through greater strategic control over day-to-day operations as well as

to accelerate decision making that would help support the Company’s business plan and commercial objectives.

Details of the assets, liabilities and net cash outflow arising from the acquisition of additional interest in BIG are as follows:

Fair value

RM’000

Cash and bank balances

22,685

Trade and other receivables

17,159

Property, plant and equipment

6,184

Deferred revenue

(35,487)

Trade and other payables

(12,598)

Net identifiable assets acquired

(2,057)

Non-controlling interests acquired

631

Goodwill on acquisition (Note 16)

102,926

Net assets acquired

101,500

[ ]

295

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS