12. Investment in subsidiaries (cont’d.)

Deemed acquisition of subsidiaries (cont’d.)

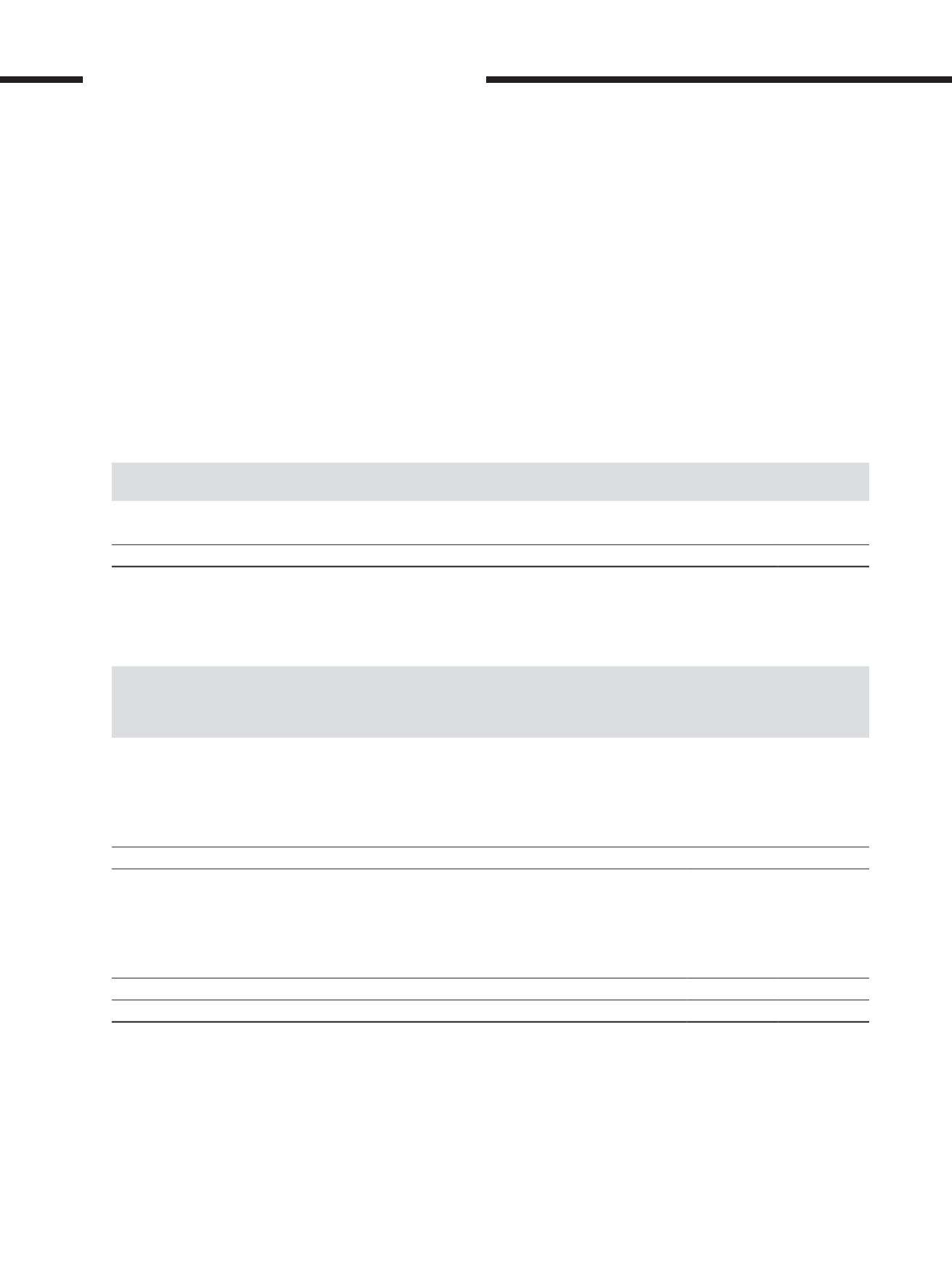

Details of the assets, liabilities and net cash outflow arising from the acquisition of additional interest in IAA and PAA are as follows:

(cont’d.)

IAA (cont’d.)

Group

RM’000

Cost of acquisition

–*

Less: Cash and cash equivalents of subsidiary acquired

(79,403)

Net cash inflow on deemed acquisition of subsidiary

(79,403)

* The cost of acquisition is nil as this is a deemed acquisition of a subsidiary.

From the date of acquisition, IAA has contributed a net loss of RM154,626,000 to the Group’s profit net of tax.

PAA

Fair value

recognisedon

acquisition

RM’000

Carrying

amount

RM’000

Assets

Non-current assets

Property, plant and equipment (Note 11)

78,590

78,590

Intangible assets (Note 16)

69,300

–

Other receivables

72,131

72,131

220,021

150,721

Current assets

Cash and bank balances

30,166

30,166

Trade and other receivables

1,715,366

1,715,366

Inventories

10,399

10,399

Derivative financial instruments

34,187

34,187

1,790,118 1,790,118

Total assets

2,010,139

1,940,839

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

[ ]

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS

290