12. Investment in subsidiaries (cont’d.)

Reverse acquisition of AAID by IAA (cont’d.)

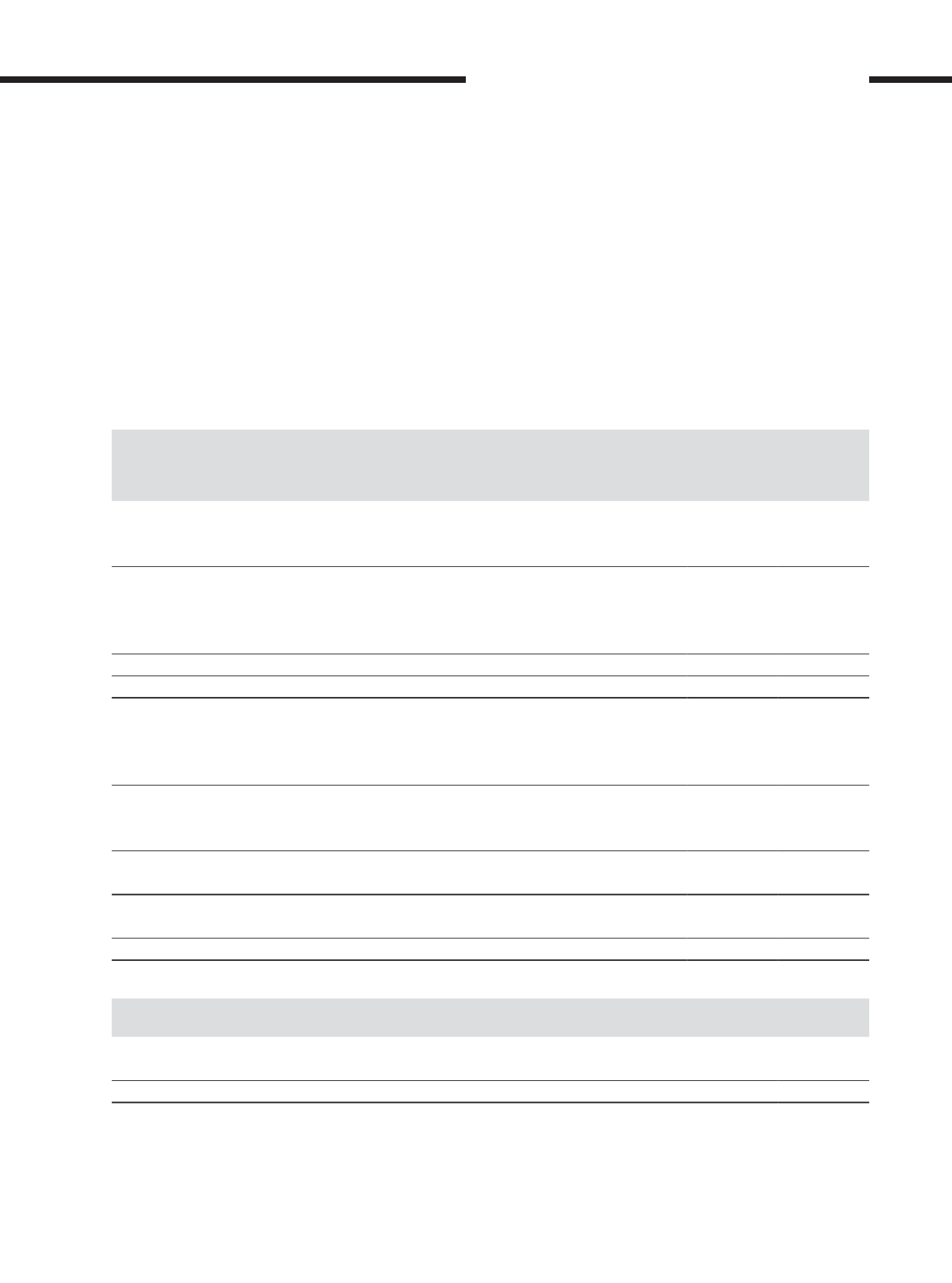

The identifiable assets of AAID were as follow:

Fair value

recognisedon

acquisition

RM’000

Carrying

amount

RM’000

Assets

Non-current assets

Deferred tax assets (Note 17)

52

52

Current assets

Cash and bank balances

4,931

4,931

Trade and other receivables

4,371

4,371

9,302

9,302

Total assets

9,354

9,354

Liabilities

Non-current liabilities

Employee benefits liability (Note 32)

207

207

Current liabilities

Trade and other payables

2,919

2,919

Total liabilities

3,126

3,126

Fair value of net identifiable assets

6,228

Acquisition cost (listing expenses)

9,235

Deemed purchase consideration (issued equity)

15,463

Group

RM’000

Cost of acquisition

–*

Less: Cash and cash equivalents arising from the reverse acquisition

(4,931)

Net cash inflow on reverse acquisition

(4,931)

* The cost of acquisition is nil as this is a reverse acquisition.

As a result of the reverse acquisition, the Group’s effective interest in IAA was diluted by 0.7% from 49% to 48.3% and the financial

effects of the reverse acquisition amounting to RM441.5 million has been credited to non-controlling interests as disclosed in the

statement of changes in equity.

[ ]

293

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS