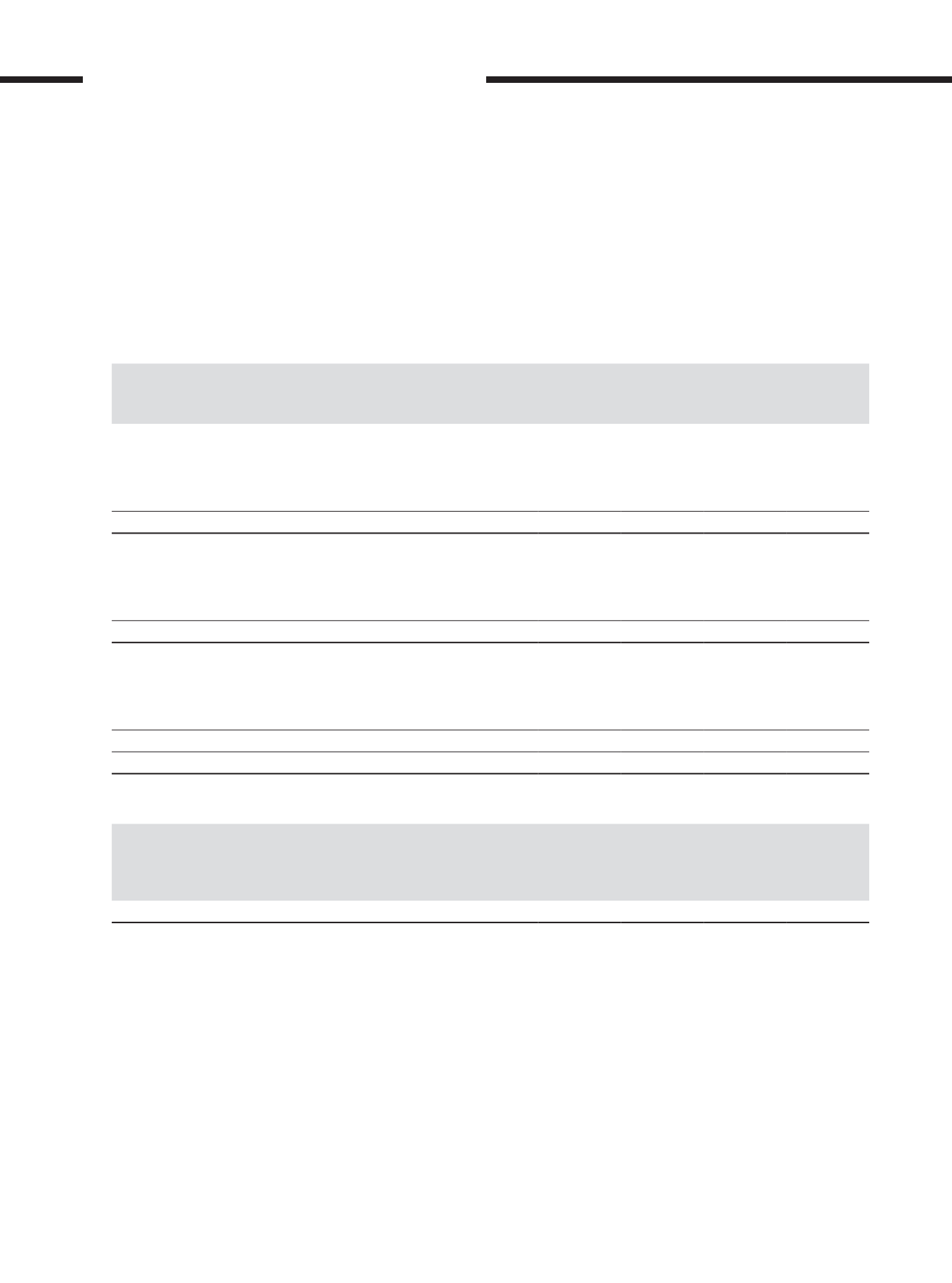

9. Taxation

Group

Company

2017

RM’000

2016

RM’000

2017

RM’000

2016

RM’000

Current taxation

– Malaysian tax

16,570

3,852

9,830

2,854

– foreign tax

36,090

2,542

5,870

2,542

Deferred taxation (Note 17)

463,754

79,739 263,482

79,739

516,414

86,133 279,182

85,135

Current taxation

– current financial year

49,306

21,981

12,346

20,983

– under/(over)provision of income tax in respect of previous years

3,354 (15,587)

3,354 (15,587)

52,660

6,394

15,700

5,396

Deferred taxation

– origination and reversal of temporary differences

394,625

64,261 194,353

64,261

– underprovision of deferred tax in respect of previous years

69,129

15,478

69,129

15,478

463,754

79,739 263,482

79,739

516,414

86,133 279,182

85,135

The explanation of the relationship between taxation and profit before taxation is as follows:

Group

Company

2017

RM’000

2016

RM’000

(Restated)

2017

RM’000

2016

RM’000

(Restated)

Profit before taxation

2,087,788

1,704,691 1,948,075 1,881,532

Tax calculated at Malaysian tax rate of 24% (2016: 24%)

501,069

409,126

467,538

451,568

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

[ ]

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS

276