3.

Critical accounting estimates and judgments (cont’d.)

3.4 Impairment assessment of intangible assets

Goodwill, landing rights and other indefinite life intangibles are tested for impairment annually and at other times when such

indicators exist. This requires an estimation of the value in use of the cash generating units to which goodwill and landing rights

are allocated.

When value in use calculations are undertaken, management must estimate the expected future cash flows from the asset or

cash generating unit and choose a suitable discount rate in order to calculate the present value of those cash flows. Further

details of the carrying value, the key assumptions applied in the impairment assessment of goodwill and landing rights and

sensitivity analysis to changes in the assumptions are given in Note 16.

3.5 Impairment of receivables

An impairment loss is recognised when there is objective evidence that a financial asset is impaired. Management specifically

reviews its receivables financial assets and analyses historical bad debts, customer concentrations, customer creditworthiness,

current economic trends and changes in the customer payment terms when making a judgement to evaluate the adequacy of

the allowance for impairment loss.

Where there is objective evidence of impairment, the amount and timing of future cash flows are estimated based on historical

loss experience for assets with similar credit risk characteristics. If the expectation is different from the estimation, such

difference will impact the carrying value of receivables. Details of receivables are disclosed in Note 18.

4.

Revenue and other income

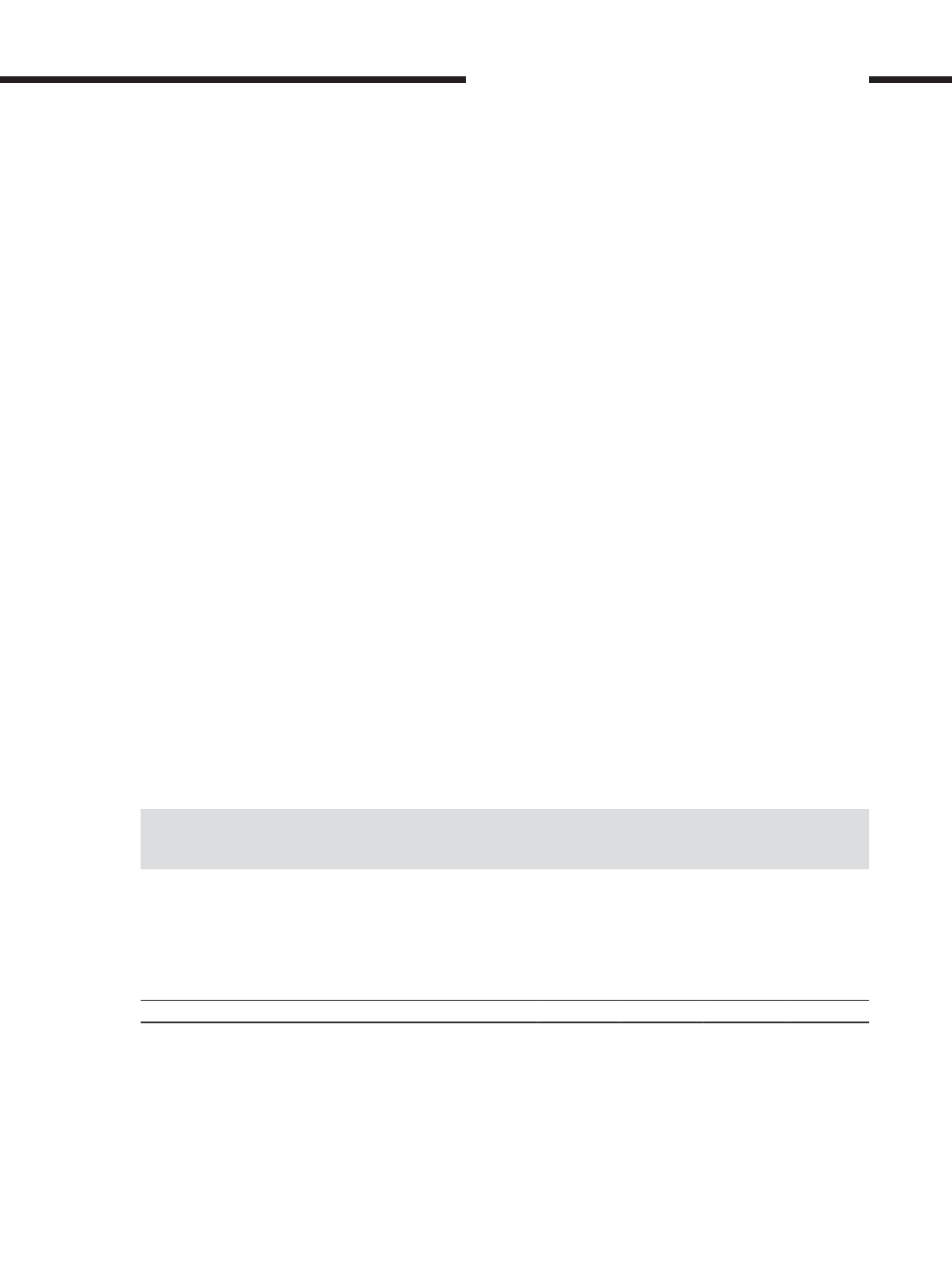

(a) Revenue

Group

Company

2017

RM’000

2016

RM’000

2017

RM’000

2016

RM’000

Passenger seat sales

6,859,805

4,391,253

4,787,425

4,391,253

Baggage fees

925,424

568,134

664,233

568,134

Aircraft operating lease income

991,549

1,257,681

276,318

359,735

Surcharges and fees

35,733

32,761

34,086

32,761

Freight services

189,428

128,582

145,103

128,582

Other revenue

707,782

467,674

533,975

467,674

9,709,721 6,846,085 6,441,140

5,948,139

Other revenue includes assigned seat, cancellation, documentation and other fees, and the on-board sale of meals and

merchandise.

[ ]

271

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS