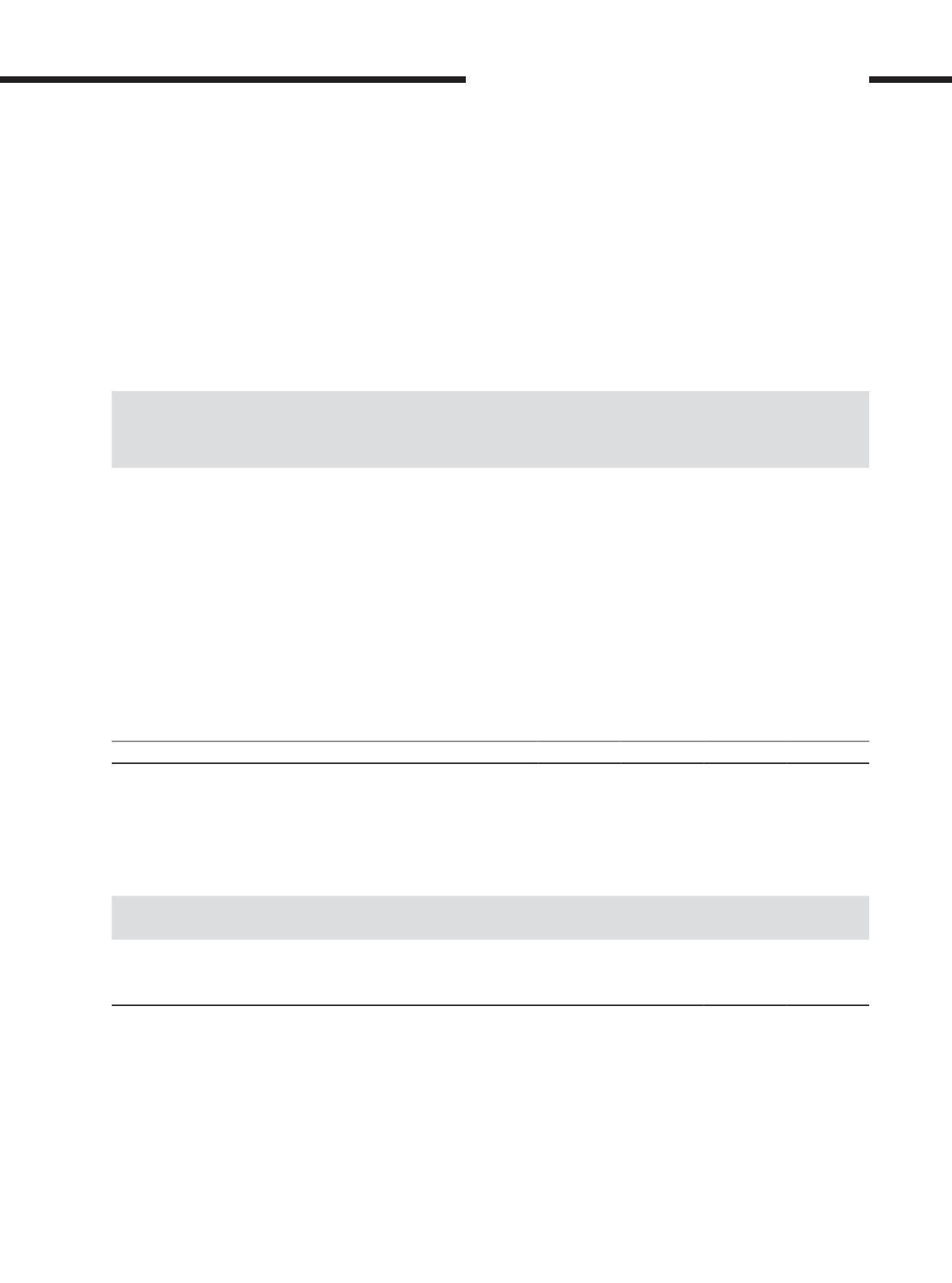

Group

Company

2017

RM’000

2016

RM’000

(Restated)

2017

RM’000

2016

RM’000

(Restated)

Tax effects of:

– expenses not deductible for tax purposes

274,065

216,510

69,991

216,481

– income not subject to tax

(224,776)

(509,271)

(224,776)

(574,770)

– associates’ results reported net of tax

(11,354)

(37,630)

–

–

– joint venture result reported net of tax

(4,782)

(5,828)

–

–

– change in statutory tax rate

–

(70,537)

–

(70,537)

– different tax rates in other countries

(416)

–

–

–

– overprovision of income tax in respect of previous years

3,354 (15,587)

3,354

(15,587)

– deferred tax assets not recognised on deductible temporary

differences and tax losses

16,179

21,370

–

–

– underprovision of deferred tax in respect of previous years

69,129

15,478

69,129

15,478

– deferred tax asset (recognised)/derecognised on investment

tax allowance

(106,054)

62,502

(106,054)

62,502

Taxation

516,414

86,133

279,182

85,135

10. Earnings per share

Basic earnings per share is calculated by dividing the net profit for the financial year attributable to owners of the Company by the

weighted average number of ordinary shares in issue (excluding weighted average number of treasury shares held by the Company)

during the financial year.

Group

2017

2016

Net profit for the financial year attributable to owners of the Company (RM’000)

1,628,774

1,621,659

Weighted average number of ordinary shares in issue (‘000)

3,303,586

2,782,874

Basic and diluted earnings per share (sen)

49.3

58.3

The Group does not have in issue any financial instruments on other contracts that may entitle its holder to ordinary shares and

therefore, dilutive to its basic earnings per share.

9. Taxation (cont’d.)

The explanation of the relationship between taxation and profit before taxation is as follows: (cont’d.)

[ ]

277

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS