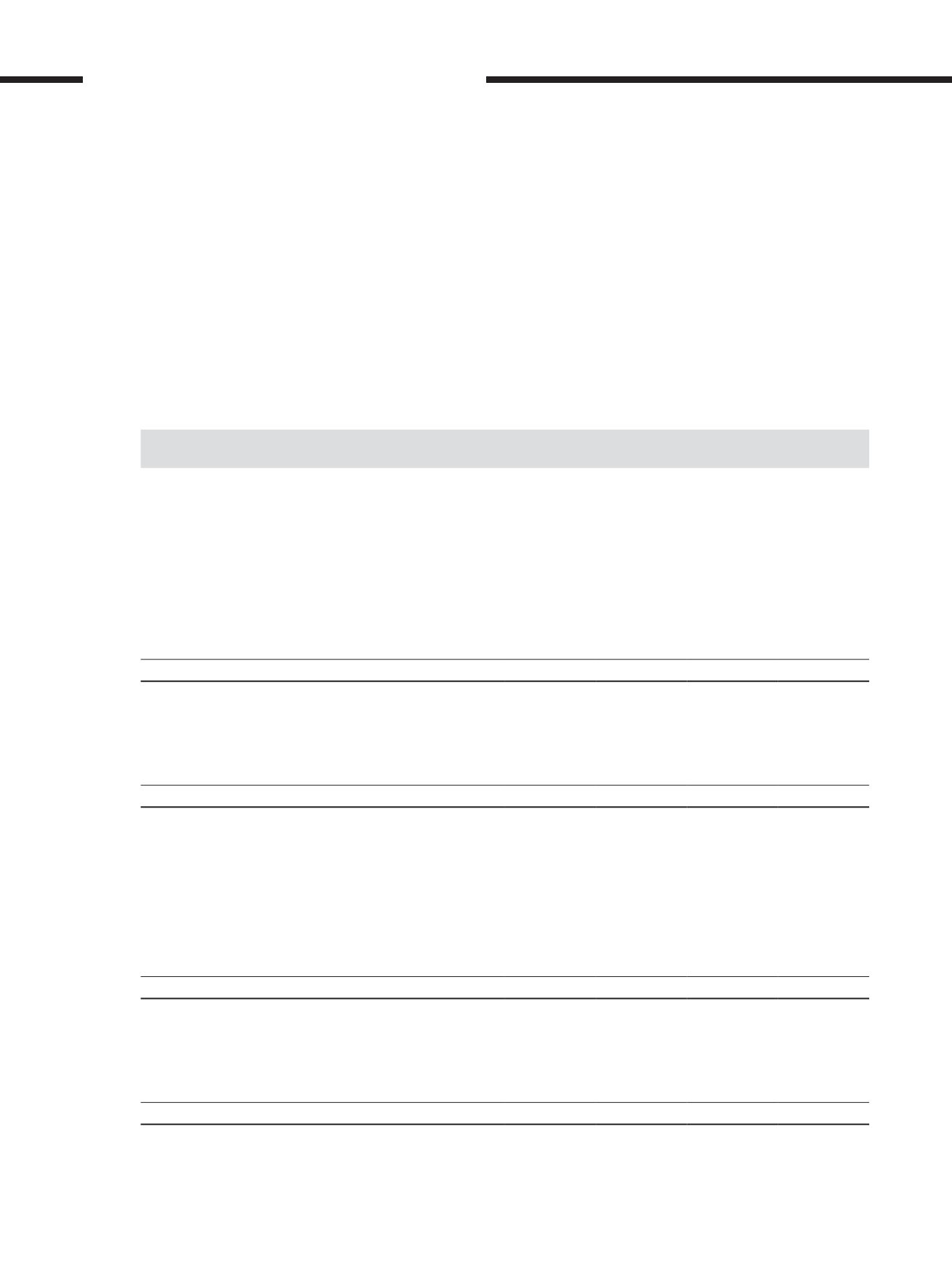

40. Financial risk management policies (cont’d.)

(e) Fair value measurement (cont’d.)

The following table presents the Group’s and Company’s assets and liabilities that are measured at fair value.

Level 1

RM’mil

Level 2

RM’mil

Level 3

RM’mil

Total

RM’mil

Group

31 December 2017

Assets

Financial assets at fair value through profit or loss

– Trading derivatives

–

261

–

261

Derivatives used for hedging

–

327

–

327

Available-for-sale financial assets

301

–

5

306

301

588

5

894

Liabilities

Financial liabilities at fair value through profit or loss

– Trading derivatives

–

92

–

92

Derivatives used for hedging

–

54

–

54

–

146

–

146

31 December 2016

Assets

Financial assets at fair value through profit or loss

– Trading derivatives

–

425

–

425

Derivatives used for hedging

–

1,108

–

1,108

Available-for-sale financial assets

351

–

6

357

351

1,533

6

1,890

Liabilities

Financial liabilities at fair value through profit or loss

– Trading derivatives

–

148

–

148

Derivatives used for hedging

–

449

–

449

–

597

–

597

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

[ ]

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS

360