40. Financial risk management policies (cont’d.)

(d) Capital risk management (cont’d.)

The Group’s and Company’s overall strategy remains unchanged from 2016.

Consistent with others in the industry, the Group and Company monitors capital utilisation on the basis of the net gearing ratio.

This net gearing ratio is calculated as net debts divided by total equity. Net debts are calculated as total borrowings (including

“short term and long term borrowings” as shown in the Group’s and Company’s balance sheet) less deposit, cash and bank

balances.

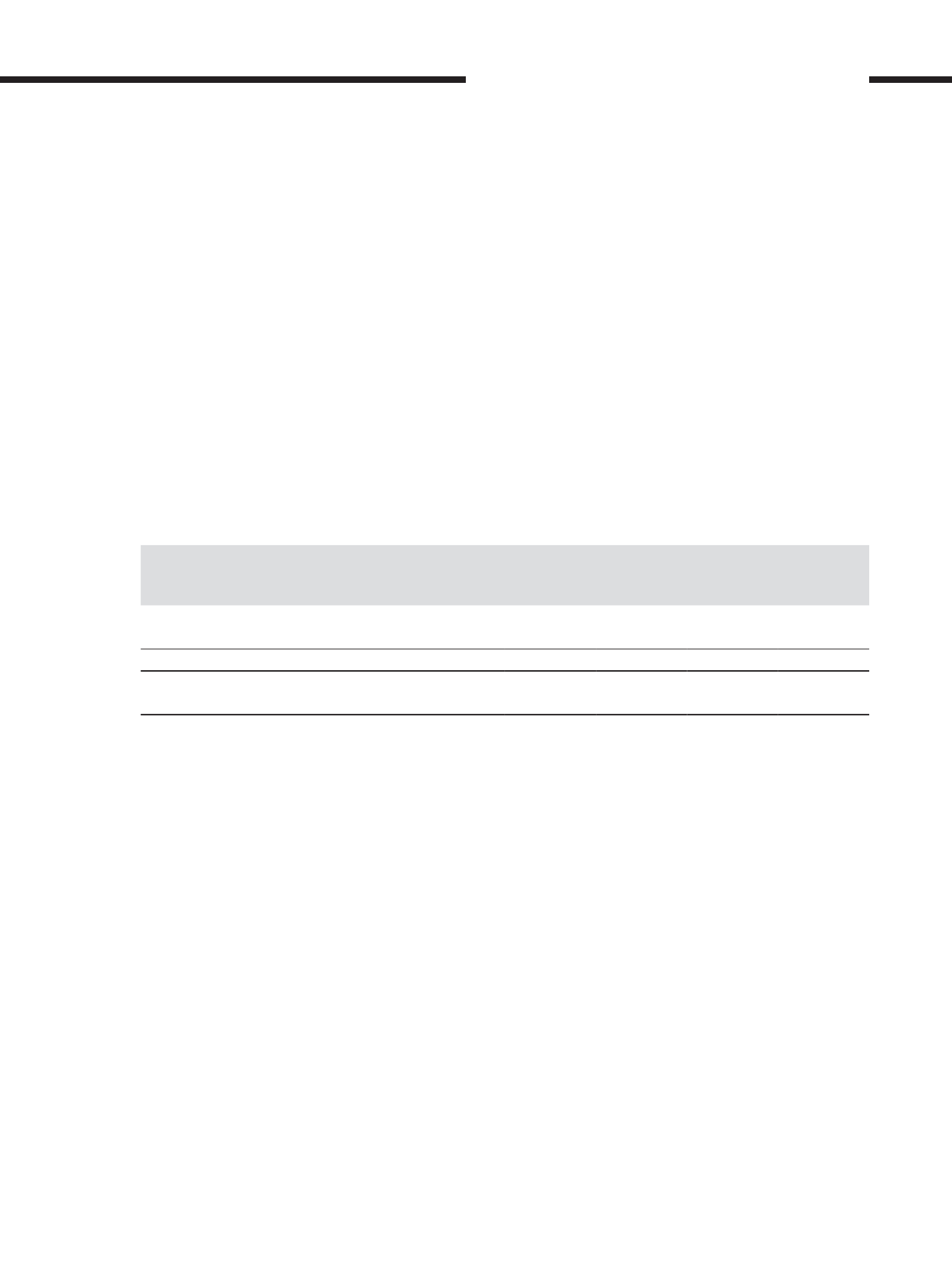

The net gearing ratio as at 31 December 2017 and 31 December 2016 was as follows:

Group

Company

2017

RM’mil

2016

RM’mil

2017

RM’mil

2016

RM’mil

Total borrowings (Note 31)

9,309

10,579

6,728

7,796

Less: Deposit, cash and bank balances

(1,882)

(1,742)

(1,302)

(1,427)

Net debts

7,427

8,837

5,426

6,369

Total equity

6,710

6,628

7,573

5,965

Net Gearing Ratio (times)

1.11

1.33

0.72

1.07

The Group and the Company are in compliance with all externally imposed capital requirements for the financial years ended

31 December 2017 and 31 December 2016.

(e) Fair value measurement

The carrying amounts of cash and cash equivalents, trade and other current assets, and trade and other liabilities approximate

their respective fair values due to the relatively short-term maturity of these financial instruments. The fair values of other

classes of financial assets and liabilities are disclosed in the respective notes to financial statements.

Determination of fair value and fair value hierarchy

The Group’s and Company’s financial instruments are measured in the statement of financial position at fair value. Disclosure

of fair value measurements are by level of the following fair value measurement hierarchy:

• Quoted prices (unadjusted) in active markets for identical assets or liabilities (level 1);

• Inputs other than quoted prices included within level 1 that are observable for the asset or liability, either directly (that is, as

prices) or indirectly (that is, derived from prices) (level 2);

• Inputs for the asset or liability that are not based on observable market data (that is, unobservable inputs) (level 3).

[ ]

359

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS