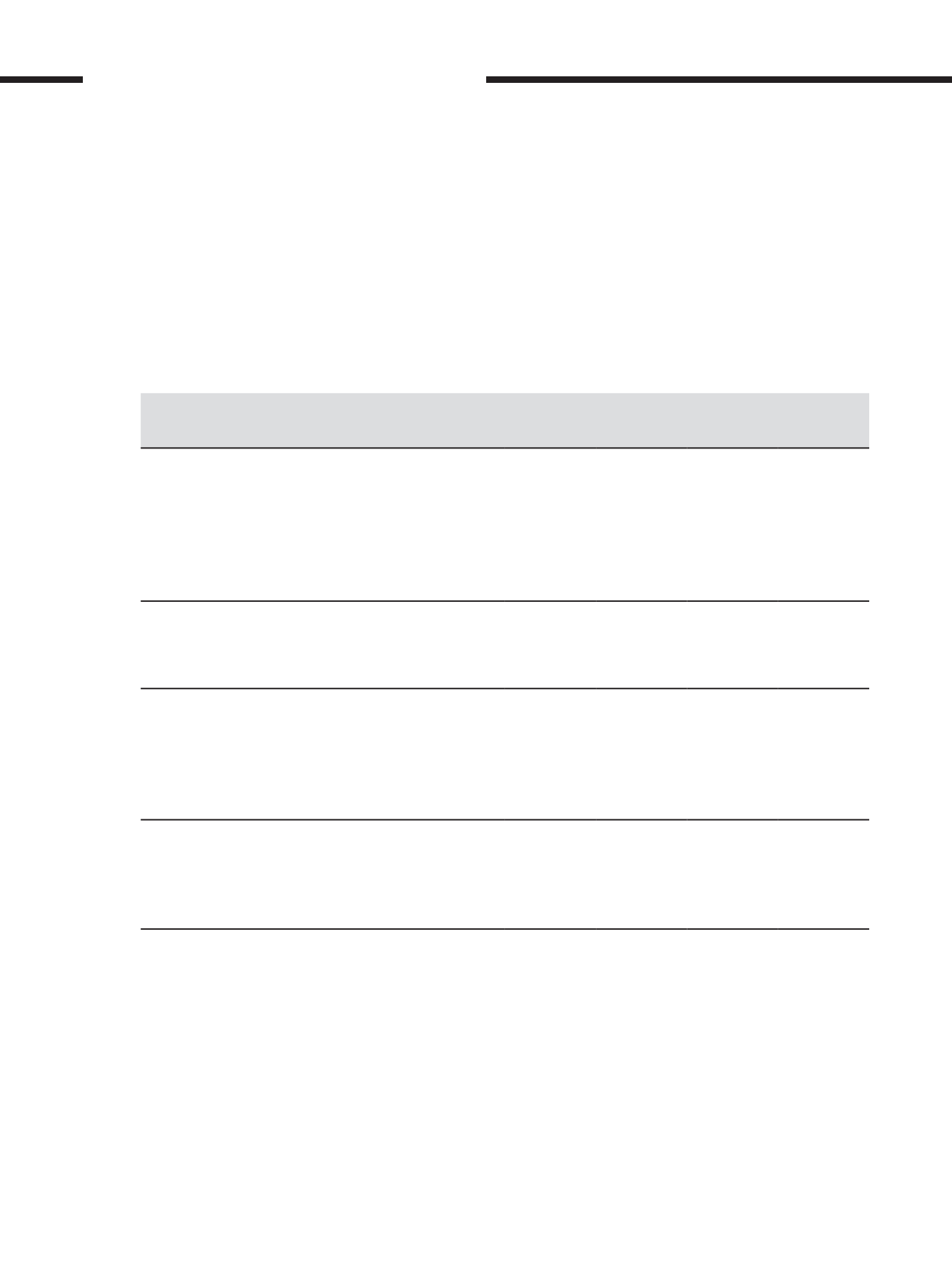

Less than

1 year

RM’mil

1 - 2 years

RM’mil

2 - 5 years

RM’mil

Over

5 years

RM’mil

Company

At 31 December 2017

Net-settled derivatives

Trading

88

12

8

–

Hedging

29

13

12

–

Gross-settled derivatives

Trading - outflow

–

–

–

–

Trading - inflow

–

–

–

–

At 31 December 2016

Net-settled derivatives

Trading

106

21

21

–

Hedging

390

30

29

–

Gross-settled derivatives

Trading - outflow

–

–

–

–

Trading - inflow

–

–

–

–

(d) Capital risk management

The Group’s and Company’s objectives when managing capital are to safeguard the Group’s and Company’s ability to continue

as a going concern and to maintain an optimal capital structure so as to provide returns for shareholders and benefits for other

stakeholders.

In order to optimise the capital structure, or the capital allocation amongst the Group’s and Company’s various businesses,

the Group and Company may adjust the amount of dividends paid to shareholders, return capital to shareholders, issue new

shares, take on new debts or sell assets to reduce debt.

40. Financial risk management policies (cont’d.)

(c) Liquidity and cash flow risk (cont’d.)

NOTES TO THE

FINANCIAL STATEMENTS

FOR THE FINANCIAL YEAR ENDED 31 DECEMBER 2017

[ ]

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS

358