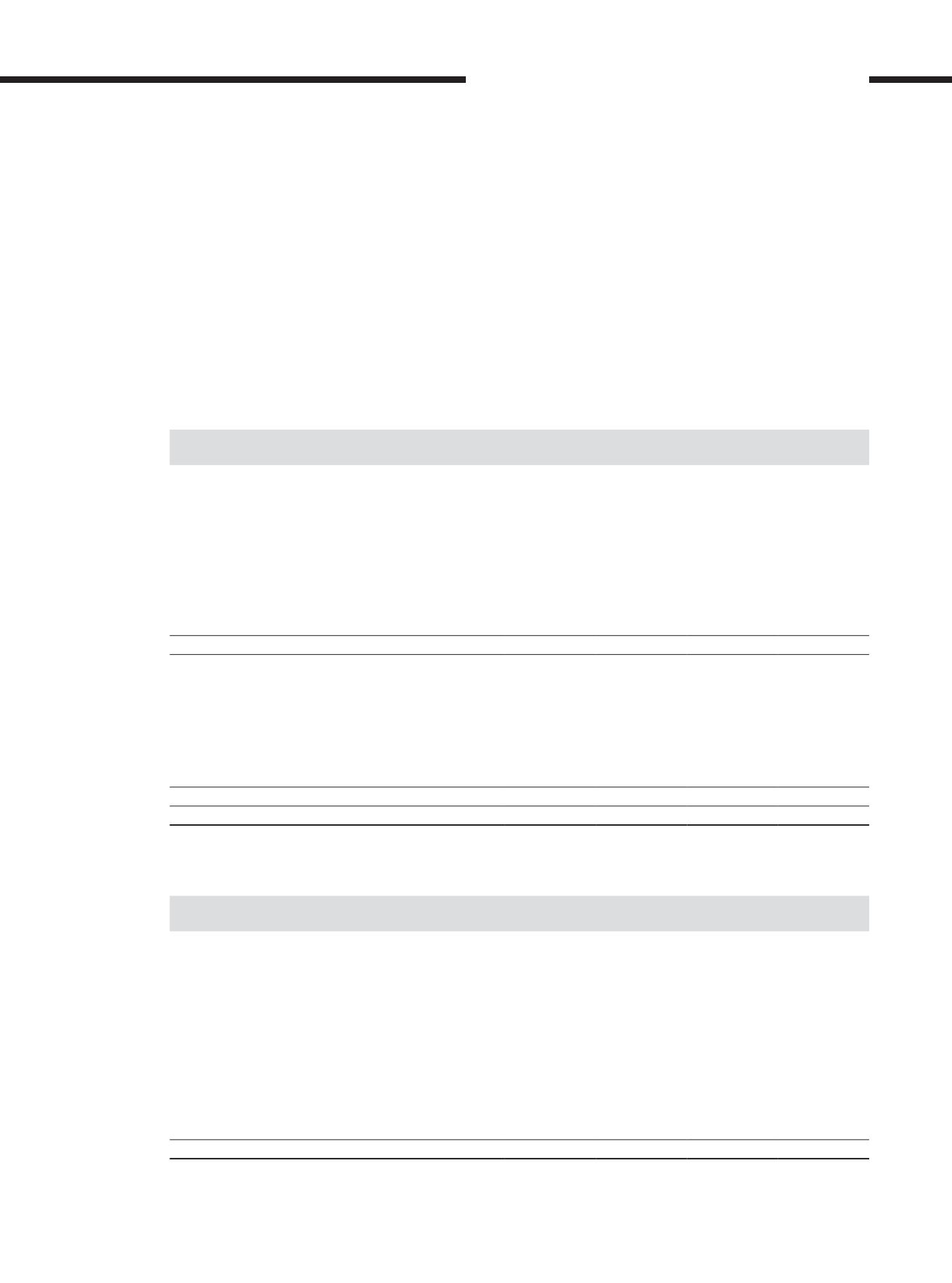

40. Financial risk management policies (cont’d.)

(a) Market risk (cont’d.)

(iii) Foreign currency risk (cont’d.)

USD

RM’mil

SGD

RM’mil

RMB

RM’mil

Others

RM’mil

At 31 December 2016

Financial assets

Receivables

611

–

–

25

Deposits on aircraft purchase

770

–

–

–

Amounts due from associates

856

–

–

–

Derivative financial instruments

750

–

–

–

Amount due from a related party

36

–

–

–

Deposits, cash and bank balances

756

39

251

250

3,779

39

251

275

Financial liabilities

Trade and other payables

827

1

–

1

Amounts due to associates

123

–

–

–

Amounts due to related parties

9

–

–

–

Borrowings

9,136

204

–

180

Derivative financial instruments

597

–

–

–

10,692

205

–

181

Net exposure

(6,913)

(166)

251

94

The Company’s currency exposure profile of financial instruments denominated in currencies other than the functional

currency is as follows:

USD

RM’mil

SGD

RM’mil

RMB

RM’mil

Others

RM’mil

At 31 December 2017

Financial assets

Receivables

631

10

–

448

Amounts due from subsidiaries

1,707

–

–

–

Amounts due from associates

108

–

–

–

Amounts due from related parties

3

–

–

–

Deposits on aircraft purchase

916

–

–

–

Derivative financial instruments

193

–

–

–

Deposits, cash and bank balances

650

–

181

321

4,208

10

181

769

[ ]

353

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS