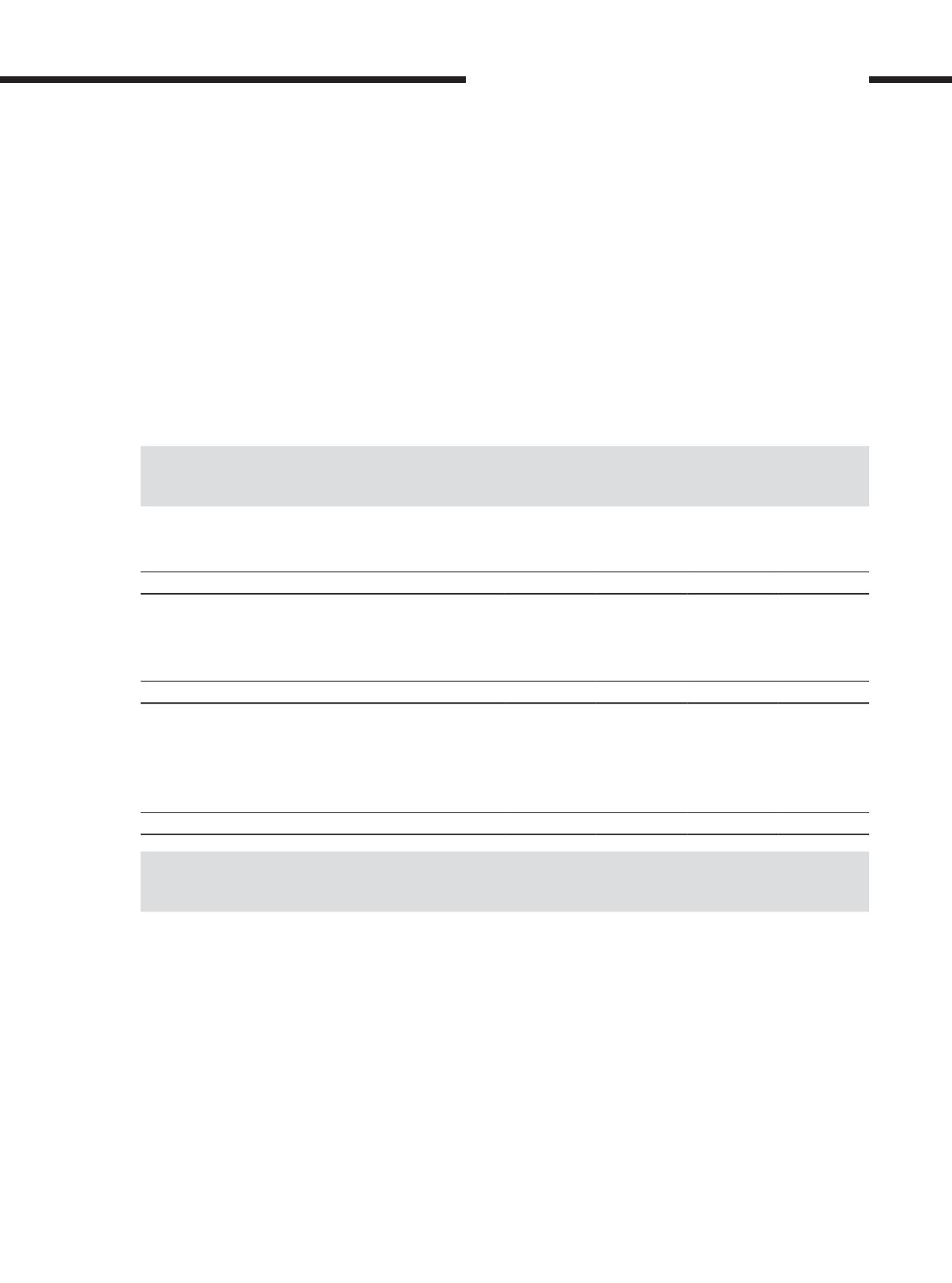

39. Financial instruments (cont’d.)

(b) Credit quality of financial assets

The credit quality of financial assets that are not impaired can be assessed by reference to external credit ratings (if available)

or to historical information about counterparty default rates:

Group

Company

2017

RM’mil

2016

RM’mil

2017

RM’mil

2016

RM’mil

Counterparties without external credit rating (Note 18)

Group 1

4

1

4

1

Group 2

192

107

63

83

196

108

67

84

Cash at bank and short term bank deposits (Note 26)

AAA to A-

1,574

1,733

994

1,418

BBB to B3

308

9

308

9

1,882

1,742

1,302

1,427

Derivative financial assets (Note 21)

AA+ to A+

471

185

471

185

A to BBB-

103

1,015

103

1,015

No rating

14

333

14

333

588

1,533

588

1,533

Group

Company

2017

RM’mil

2016

RM’mil

2017

RM’mil

2016

RM’mil

Amounts due from subsidiaries

Group 2

–

–

1,582

801

Amounts due from joint ventures

Group 2

5

9

–

9

Amounts due from associates

Group 2

148

856

108

627

Amounts due from related parties

Group 2

8

37

3

16

Group 1 -

New customers/related parties (Less than 6 months)

Group 2 -

Existing customers/related parties (more than 6months) with no defaults in the past.

Group 3 -

Existing customers/related parties (more than 6months) with some defaults in the past.

[ ]

349

AirAsia Berhad

REPORTS AND FINANCIAL STATEMENTS