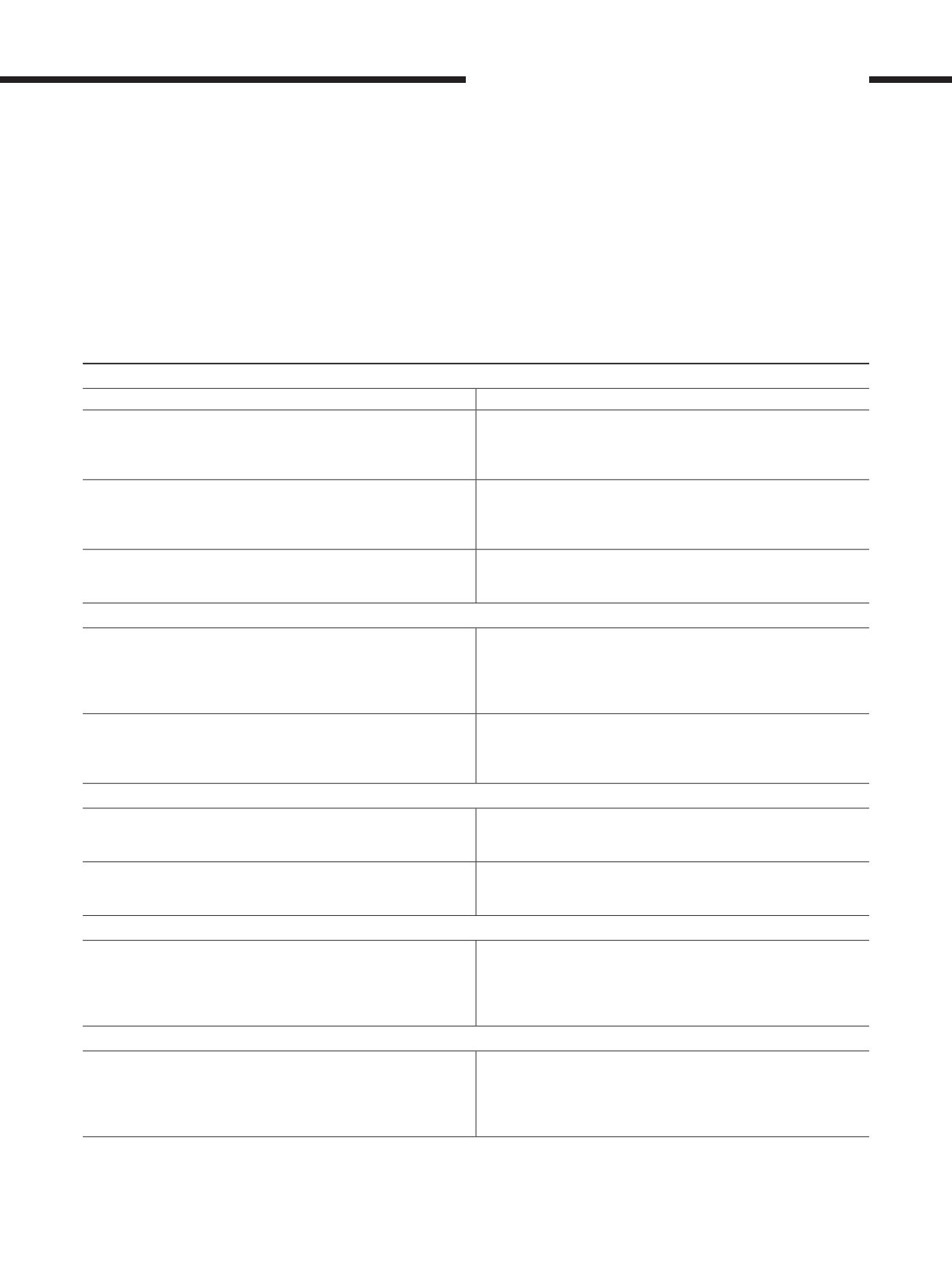

SIGNIFICANT RISKS

STRATEGIC RISKS

RISK

MITIGATION ACTION

Sales Shocks

- Changes in demand caused by events such as

political unrest or market downturns could impact our revenue stream

significantly.

The Commercial Department conducts periodic market analysis and

coordinates responses to market events. The Group has also launched

low-fare promotions from time to time to generate sales in periods

of low demand.

Competition

- Intense competition from expansion of competitor’s

network and price erosion stemming from price wars.

Strategic network expansion into greenfield markets to achieve “first

entrant” incentives such as lower airport charges. The Group also

utilises revenue modelling to lower price points for targeted routes

to maximise profitability.

Negative Publicity

- reputational risk stemming from social networks

that serve as platforms for airing consumer grievances or anti-

organisation campaigns.

The Group conducts annual brand health assessments, the results

of which have been used to execute positive public relation actions

including targeted marketing campaigns.

OPERATIONAL RISKS

SystemOutages

- Outages of mission-critical systems required for the

continuity of flight operations and revenue channels have occurred

more frequently in the commercial aviation industry over the past 12

months resulting in significant losses to the affected airlines.

The Group has developed, implemented and tested systems-specific

backup and failovers to reduce the impact of system outages. In

addition, the Group has developed an IT Disaster Recovery Plan and

a complementary Group Operational Response Plan to ensure that

the business continues to run in the event of a critical systems outage.

Supply Chain

- Failure in airport services such as airport fuelling

systems, baggage handling systems or customs, immigration and

quarantine processing could lead to significant delays and business

disruption.

The Group has created incident-specific business continuity plans for

our main hubs while partnering closely with airport operators and

authorities.We have also developed and tested fuel supply disruption

business continuity plans for KLIA2.

FINANCIAL RISKS

Fuel Price Risk

- A surge in fuel price would have a significant impact on

the Group profits with fuel making up one of the key cost components

for operations.

The Group manages the exposure to jet fuel price risk arising from

fluctuations in the price of jet fuel through hedging strategies.

Foreign Currency Risk

- Unexpectedmassive currency depreciation, in

particular theMalaysian Ringgit to the US Dollar, will have a detrimental

effect on the Group’s cost of financing.

The Group manages these exposures by hedging strategies including

derivative products.

CYBER SECURITY RISK

Cyber Threats

- The Group is exposed to cyber threats due to our

heavy focus on online sales channels, guest feedback, help channels

and other digital solutions.

The Group has established a centralised team responsible formanaging

and improving its cyber security. This team regularly reviews and

monitors cyber threats globally. The Group has also achieved ISO/IEC

27001 Information SecurityManagement System (“ISMS”) certification

for its control systems.

COMPLIANCE RISK

Non-Compliance to Regulatory Requirements

- The Group must meet

regulatory requirements of local aviation and consumer authorities

in multiple jurisdictions.

The Group maintains a high level of engagement with local regulators

and authorities to ensure any new regulatory requirement is understood

and swiftly adhered to. In addition, we constantly monitors the local

regulatory landscape for new or amended regulations affecting the

Group.

[ ]

AirAsia Group Berhad

REPORTS AND FINANCIAL STATEMENTS

199