In October, we started to personalise our

communication with guests using data

analysis. This helped to increase the take-

up of a range of services – from inflight

food to duty-free.

Among our ancillary services, we were

especially pleased with Fly-Thru,

which is a key differentiator for AirAsia,

providing our guests an extensive network

that includes the routes of all country

operations as well as those of our sister

AirAsia X Group. During the year, Fly-Thru

for both AirAsia and AirAsia X Groups saw a

37% increase in take-up to 3.01 million. This

was aided by the addition of 497 new city

pairs, to total 1,845 routes. klia2 continued

to be the top transit hub, accounting for

85% of the overall Fly-Thru traffic, with

2.5 million guests passing through the

airport during the year. Meanwhile, our

operations in India saw the highest growth

in Fly-Thru traffic, its hubs in Bengaluru,

Kolkata and New Delhi accommodating a

677% increase in transit guests. Overall,

AirAsia and AirAsia X Groups recorded

RM204.1 million from Fly-Thru in 2017, and

we foresee higher uptakes in coming years

as we integrate our operations more fully

and efficiently.

As our digital transformation progresses,

we will be able to capture even more

data on our guests and use this for more

targeted up-sell and cross-sell of ancillary

products. Towards the end of the year,

we started using electronic point of sales

(ePOS) devices for inflight transactions,

and have integrated the data obtained onto

our centralised platform. This enhances

our guest profiles and will guide us in

serving them better. It also gives us the

confidence to target achieving RM60

in ancillary income per guest by 2020

from RM49 as at end 2017. Some say it is

ambitious, but we ‘dare to dream’.

ADJACENCY BUSINESSES

Adjacency businesses are those we have

established – mostly in partnership with

other companies, but some also on our

own steam – to generate income from our

assets and resources. A number of these

companies have begun to earn sizeable

revenue, prompting us to monetise them to

recognise their value. The process began

in 2015, when we disposed of 25% of our

equity in AirAsia Expedia, our online travel

85

%

of Fly-Thru guests transited

in Kuala Lumpur

3.01

MILLION GUES T S

in 2017, 37% more

than in 2016

677

%

increase in transit guests

in India in 2017

AIRASIA GROUP FLY-THRU

(Including AirAsia X Group)

company. The year 2017 was significant

as we took our monetisation programme a

notch higher.

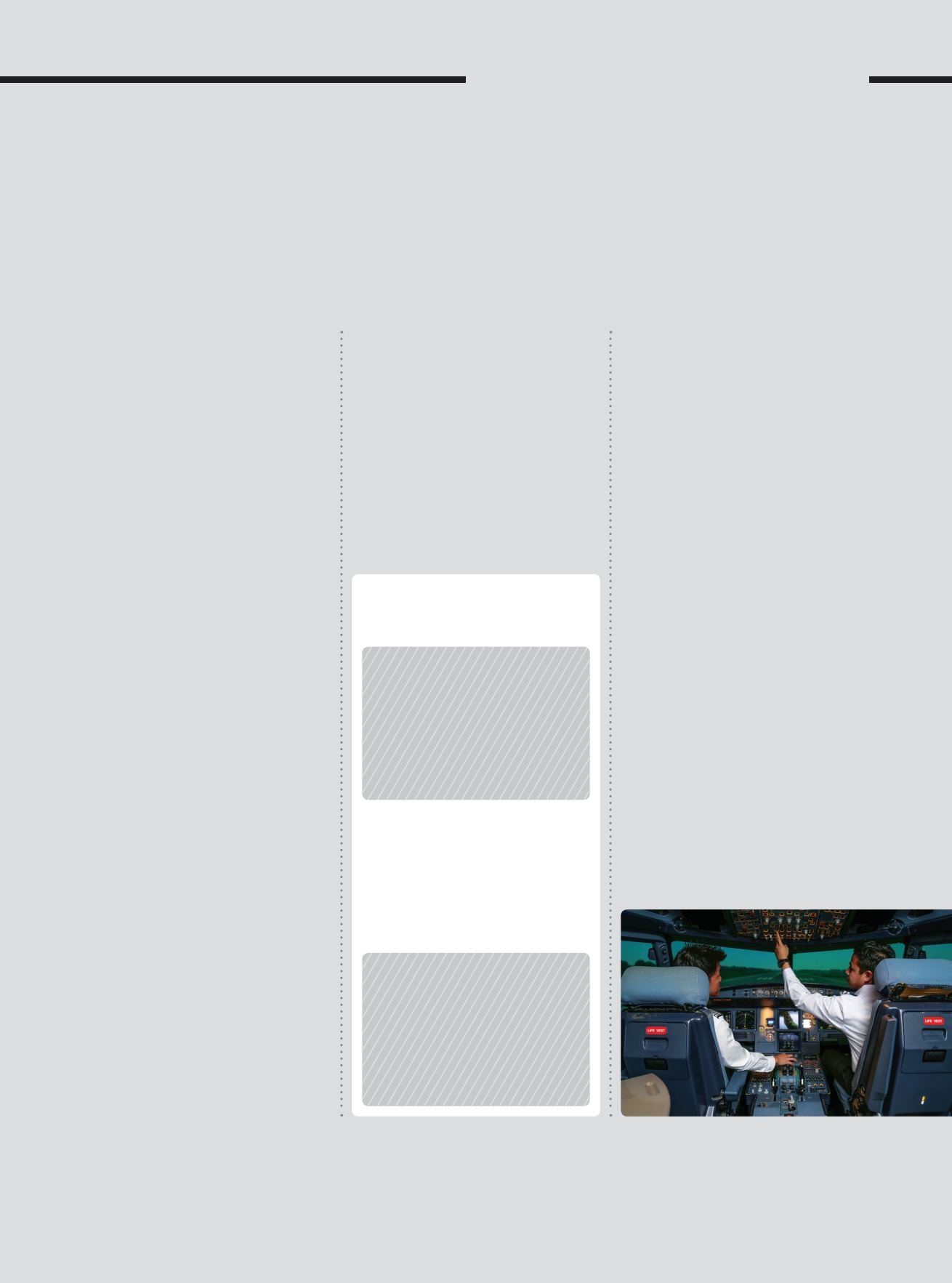

In August, we concluded the sale of AACE,

the training company we had established

in 2011 with CAE International Holding

Ltd (CAE), to our Canadian partner for

USD100 million. This effectively gives CAE

full control over AACE’s training centres

in Sepang, Singapore and Ho Chi Minh

City – as well as its share of the Philippine

Academy of Aviation Training (PAAT), a

joint-venture between AACE and Cebu

Pacific, located in Manila. As our exclusive

training partner, CAE will continue to

provide the highest quality training of

pilots and cabin crew at agreed rates for

the entire Group until 2036.

[ ]

AirAsia Group Berhad

PERSPECTIVE

95