AirAsia Indonesia

After a couple of years of capacity

rationalisation, in 2017 AirAsia Indonesia

(PT Indonesia AirAsia) welcomed a new

aircraft, increasing its fleet to 23, and

introduced two new international routes,

further reaffirming AirAsia’s leadership

as the airline group with the largest

international travel market share in the

country. Despite volcanic activity impacting

travel into Indonesia in the fourth quarter,

our associate flew a total of 6.7 million

guests for the year, down only 1% from the

number in 2016, and maintained a healthy

load factor of 84%. Its net operating profit

stood at IDR378.5 billion while profit

before tax was IDR300.30 billion. Since

the official listing of PT AirAsia Indonesia

Tbk, the holding company of PT Indonesia

AirAsia, on 29 December 2017, retail

investor interest in PT AirAsia Indonesia

Tbk has been growing.

AirAsia Philippines

We are extremely proud of the turnaround

by our Philippine operations, proving that

perseverance and our business model

truly work. Despite numerous one-off

costs for aircraft redeliveries, maintenance

and overhaul throughout 2017, AirAsia

Philippines grew its revenue 48% from

PHP10.80 billion in 2016 to

PHP15.93 billion and achieved a net

operating profit of PHP686.4 million

backed by ASK growth of 37%. Revenue

was boosted by a 32% increase in number

of guests carried and 8% increase in

average fare. While increasing its capacity

by 31% our Philippines operations

also maintained its load factor at 87%.

Meanwhile, ancillary income per guest

grew 26% from PHP419 to PHP528.

AirAsia India

Our associate airline in India achieved

tremendous growth in 2017, increasing

its revenue 86% from INR8.26 billion to

INR15.36 billion, boosted by an 81% hike in

number of guests carried. The delivery of

six aircraft during the year enabled AirAsia

India to increase its capacity by 80% via

route network expansion that included

five new destinations. Ancillary income

per guest also grew 8% from INR376

to INR408 while its load factor stood at

87%, an increase from 86% in 2016. Most

encouragingly, our associate recorded its

first net operating profit of INR144 million,

in the fourth quarter. With its affordable

fares, AirAsia India is stimulating demand

in the country.

AirAsia Japan

AirAsia Japan took off commercially on

29 October 2017, stamping its operations

with a high level of efficiency, its single

aircraft achieving an on-time performance

of 90% on the twice daily route between

Nagoya and Sapporo. With two aircraft

in 2018, our associate will focus on route

expansion.

EXPANSION INTO THE REGION

We have come a long way from our

humble beginnings, yet are still some

distance from filling all the dots within

the Asean, and certainly the Asian, map.

In 2017, however, we managed to make

positive advances in this regard, clearing a

path towards setting up operations in two

markets that have great appeal and that

would help us complete the loop of airlines

we have created within the Asia-Pacific

region.

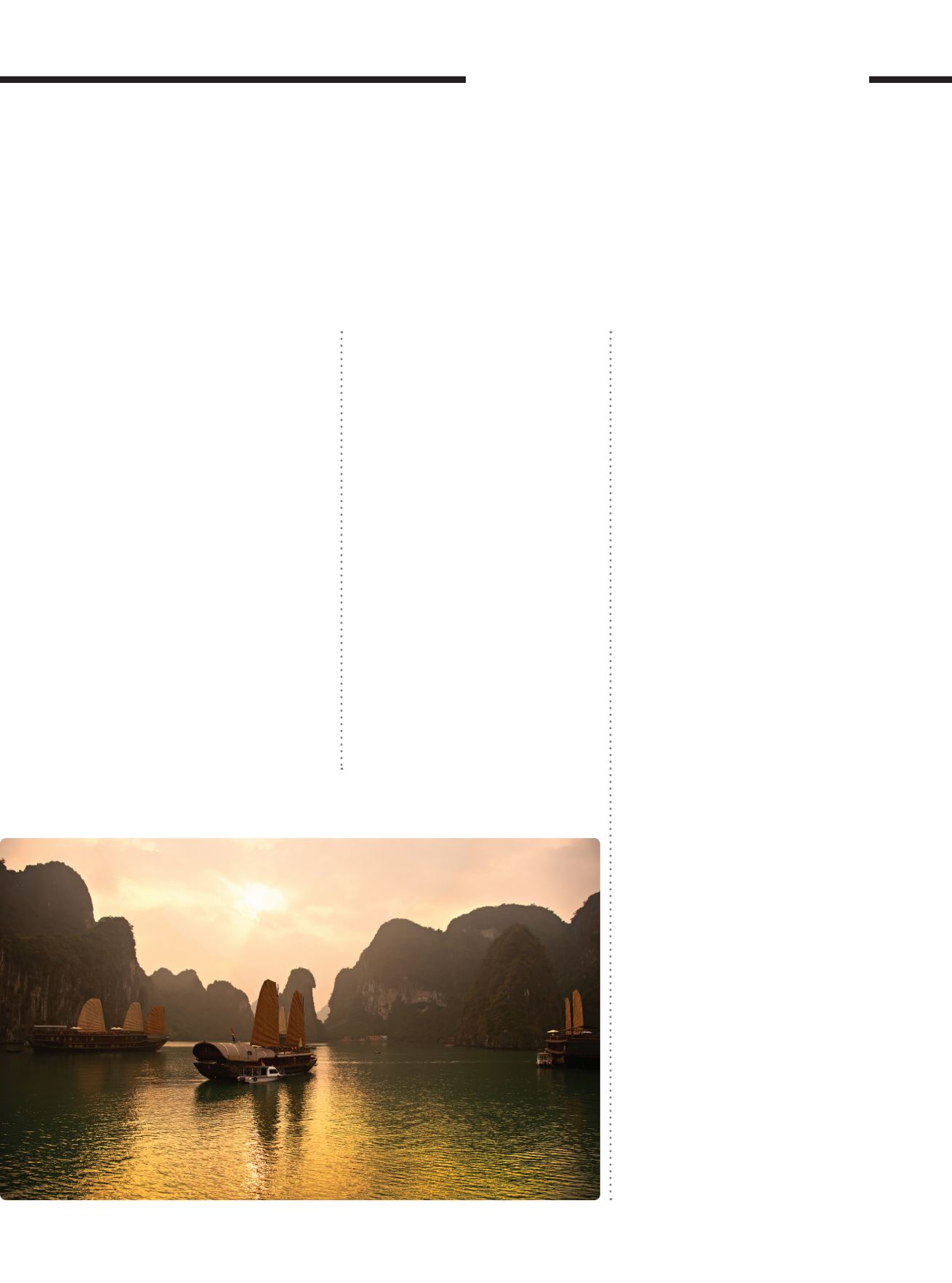

After years of eyeing Vietnam, we have

finally found suitable partners for a joint

venture there. The country has always

attracted us because of its sizeable

population of 95 million, fast-expanding

middle income segment and rapid growth

in air travel which, in the last two years,

was the fastest in the world. This growth,

moreover, is set to continue in double

digits over the next decade . We are very

excited by the prospect of being part of this

growth, and indeed to stimulate it further.

[ ]

AirAsia Group Berhad

PERSPECTIVE

93