MANAGEMENT DISCUSSION & ANALYSIS

AIRASIA MALAYSIA

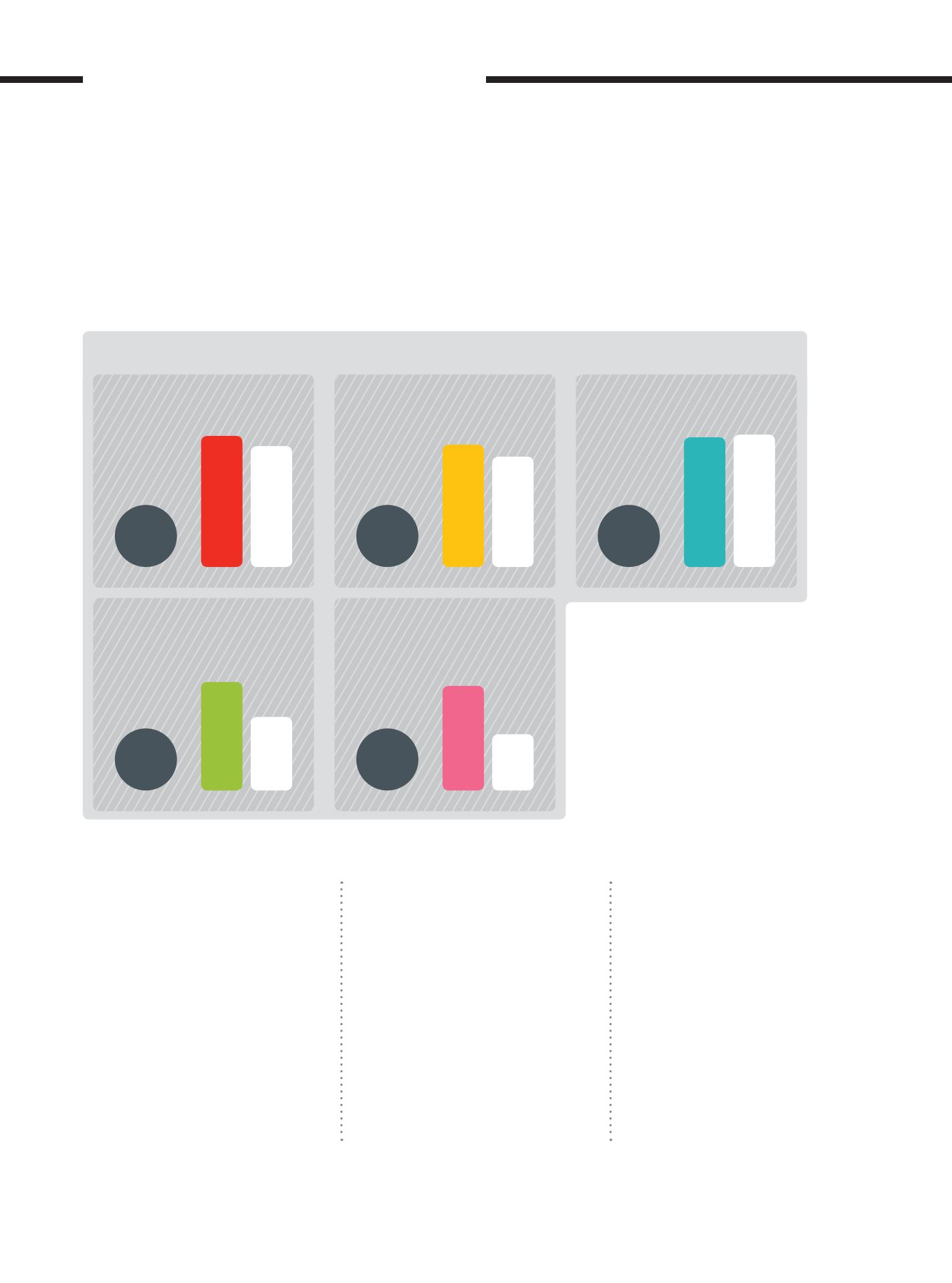

(RM BILLION)

AIRASIA PHILIPPINES

(PHP BILLION)

AIRASIA THAILAND

( T HB BILLION)

AIRASIA INDIA

(INR BILLION)

AIRASIA INDONESIA

(IDR BILLION)

2017

2017

2017

2017

2017

6.44

15.93

35.93

15.36

3,818

5.95

10.80

32.40

8.26

3,889

2016

2016

2016

2016

2016

8

%

INCREASE

48

%

INCREASE

11

%

INCREASE

86

%

INCREASE

2

%

DECREASE

PERFORMANCE OF ASSOCIATE COMPANIES (REVENUE)

PERFORMANCE OF COUNTRY

OPERATIONS

AirAsia Malaysia

With seven new aircraft, AirAsia Malaysia

continued to grow its route network both

domestically and regionally to further

entrench its position as the leading airline

in the country, contributing to the Group’s

54.3% and 30.8% share of the domestic

and international markets respectively.

Its 8% increase in capacity also saw the

airline fly 10% more guests totalling 29.2

million. Strong performance, as indicated

by an 89% load factor; aircraft utilisation

of 14 hours a day; and 2% increase in

revenue per guest, led to AirAsia Malaysia

achieving a 2% increase in RASK to 14.49

sen. For the full year, its revenue grew 8%

to RM6.44 billion while net operating profit

was recorded at RM1.51 billion.

AirAsia Thailand

Despite the government’s crackdown on

zero-dollar tours from China and mourning

over the passing of their King, AirAsia

Thailand pulled together a robust set of

results. While increasing its capacity by

11%, it flew 15% more guests year-on-year

totalling 19.80 million and grew its load

factor three percentage points to 87%. This

contributed to an 11% surge in revenue

from THB32.40 billion to THB35.93 billion.

Although CASK – including fuel and a

hike in excise tax on jet fuel consumption

for domestic flights – increased by 7% to

THB1.52, its RASK grew 2% to THB1.61,

enabling our associate to record a profit

after tax of THB2.69 billion, making it the

only profitable airline in the country for

the year. Meanwhile, its EBIT and EBITDAR

margins stood at 9% and 27%, respectively.

[ ]

AirAsia Group Berhad

PERSPECTIVE

92